EUR ping pong price action expected by jaded traders

Greece delivers: Is it enough?

EZ/EU Officials see deal unlikely today

Greek investors optimistic: stocks up, spreads tighter

Greece has followed through on demands by EU officials and delivered new proposals ahead of todays supposedly ‘make or break’ Euro emergency summit. The market is getting mixed messages on whether there will be a Greek solution found later this afternoon.

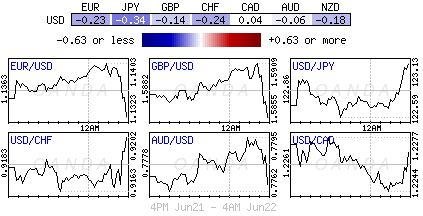

European Commission President Juncker say’s he does not know if there will be one, while EU Economic Commissioner Pierre Moscovici said he was “convinced” that eurozone leaders holding an emergency meeting in Brussels would find a way out of the Greek crisis. The talks will start in a couple of hours and are expected to go well into the night. It does seem that the new proposals may be well received and there could be an eleventh hour deal in the works. However, asset prices will obviously be susceptible to Greek headlines. Investors should be preparing for ‘ping-pong’ price action.

Earlier this morning the ECB supposedly approved additional liquidity to keep Greece’s financial wheels greased. It is the third time that the ECB has upped the Bank of Greece’s ELA over the past six-days. This had been necessary as today’s Greek banking sector pre-order withdrawals of cash was said to be over +€1.0b. Last week over +€4.2b was drained from deposit accounts.

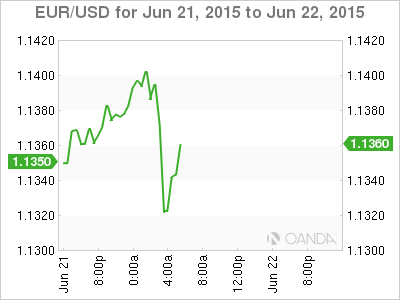

EUR is neutral territory

The single unit has now returned to trading in neutral territory, the mid-point from last Friday’s and the overnight range (€1.1340-50), and this after having filled in the gap from the Asian session (€1.1404 high overnight).

For the majority of traders and speculators, the risk/reward still favors buying EUR’s on dips. However, no matter what the spin-doctors are saying ahead of today’s summit, the Greek Prime Minister is still looking for an agreement without VAT hikes. The unpredictability will lead to more anxious moments for investors and traders who have been forced to watch headlines. Any mention of Grexit will have traders nervously scuttling for the exits.

On the flip side, Greek investors certainly seem optimistic over the ongoing negotiations between their Prime Minister Tsipras and the country’s creditors. In the bond market, Greek/German spreads have tightened significantly this morning. Greek 10-year debt (+11.30%) is about -145bps tighter to the German 10-year Bund (+0.81%) as the market heads stateside. However, perhaps more significant is that two-year Greek paper (+25.23%) is a stunning -370bps tighter to the German Schatz (-0.184%: two-year debt issued by the German Federal Government). Obviously poor liquidity is contributing to some of the price action along with the uncertainty over what the Greek proposals actually are.

Supposedly, the reforms are to gradually raise retirement age to 67. Greek officials have offered to have +23% as main VAT, +13% for energy and basic food and +6% for medicine/ books.

Do not be surprised that Euro officials will not be able to formulate a common stance as early as this evening. If there is progress today, the market should be interpreting this as a deal to be confirmed over the next few days. Any progress in talks will have Greece pushing away from a potential default scenario.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.