EUR prints a two-month high

German Bund yield correction continues

U.S ISM manufacturing PMI could cause problems in thin conditions

U.K manufacturing PMI hurts sterling’s expectations

This time last year the Euro was trying desperately to drop through its one-month low of €1.3800. A year on, the single unit is again making some significant strides, albeit from much different price levels.

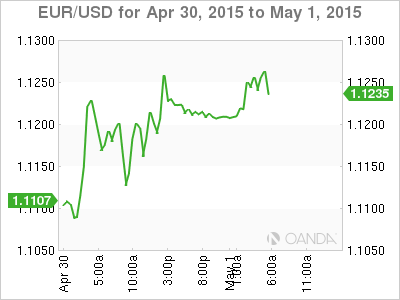

The EUR has started the month of May climbing to a new two-month high against the dollar Friday (€1.1258), extending its recent rebound outright in quiet European holiday trade.

The ECB’s €60b a month bond buying stimulus program managed to push the common currency down below the psychological €1.05 handle only six-weeks ago. With the market so bullish on the Fed timing of their first rate hike; many investors had expected that it was only a matter of time that the EUR would be trading at parity.

The Euro/U.S rate divergence argument (a hawkish Fed and a dovish ECB) has seen investors plough into the short EUR, long USD positions for months. So much so, that +78% of all forex long dollar positions has been against the Euro. The one directional, lopsided trade was always going to be in danger if any of the parameters suddenly changed.

Corporate Issuance and Supply Pressure Bond Prices

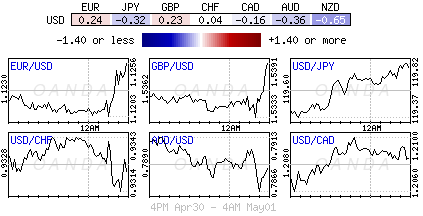

A string of weak U.S economic data releases in April (GDP, business investment, NFP) attributed to the dovish shift in Fed expectations. This change in sentiment initiated the broad dollar weakness, which has been supported by the assertive rally in German Bund yields this week.

The ECB’s aggressive QE program has encouraged investors to own core Eurozone bonds and stocks, alongside a massive build up in EUR short positions. The 10-year German bund has managed to back up +25bps as investor’s appetite for fixed income with a negative or flat return diminishes.

The loss in fixed income has pressured the DAX and in turn has encouraged some aggressive EUR/USD short covering. The rise in German yields is also encouraging investors to consider switching from EUR to JPY as the funding currency of choice.

Despite the European bond markets being closed for the May Day holiday – FX is open – there is little evidence that this week’s correction wants to come to an end. The dollar is heading stateside weaker against most G7 currencies. Against the EUR, crucial technical pivots remain intact (€1.0860 week’s low & €1.1320) and strong EUR offers are understood to be placed ahead of €1.1300 (option barrier protection). Above this level with momentum, a plethora of stop-losses are rumored to be parked, potentially opening the way for the February 3 high of €1.1534.

Speculators or “hot” money have been buoyed by yesterdays better than expected U.S data (Initial weekly claims and Employment Cost Index). They are keen to reenter there mostly closed out EUR ‘short’ positions as the data has boosted their expectations for next weeks NFP report. However, today’s U.S ISM Manufacturing PMI may have something to say about that (52 vs. 51.5). It is been released in ultra thin conditions, which tends to exaggerate forex price moves.

U.K Manufacturing takes a hit

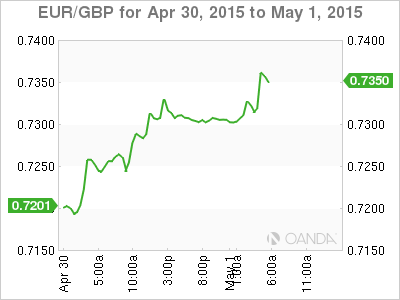

Month end EUR/GBP (€0.7360) buying yesterday was a prime factor in the Euro’s gains and because of event risk, next week’s U.K election is expected to keep the cross relatively perky.

Disappointing data out of the U.K this morning has been lending a helping hand to keep pressure on sterling. Outright, the pound is again eating through the bids at £1.5300 on the back of the U.K manufacturing PMI miss (51.9 vs. 54.6e – the lowest in seven months).

A print like this would suggest that the U.K economy wouldn’t be recovering quickly from its surprisingly sharp Q1 slowdown. Digging deeper, the data insinuates that U.K manufacturing is going to have a tough go of it over the coming months – new-orders are sliding, particularly on the export front due to the EUR/GBP underperforming. This is not good news for either Prime Minister Cameron ahead of next week’s election, nor for the “hawks” advocating a U.K rate hike before 2016.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.