EUR fails to roll over on soft flash numbers

ECB Chief economist sees Europe on growth track

Hawkish Talk on Greece Lifts EUR

Far East PMI’s reveal significant deterioration

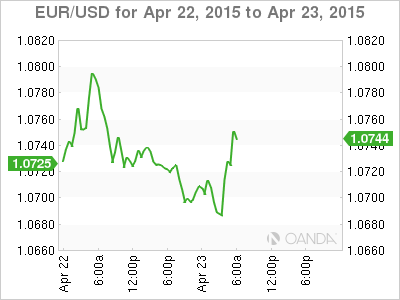

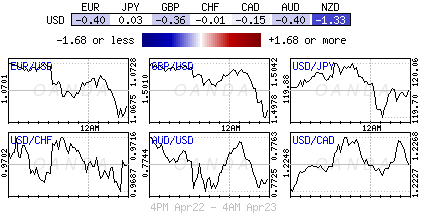

Notwithstanding the lack of fundamental data on show this week, the EUR bear has been trying valiantly to build up a head of steam ahead of tomorrows important Eurogroup meeting in Riga, Latvia. With the market not yet privy to any new hard developments on the Greek creditor fiasco, the Euro naysayers have been rather content to continue to short the EUR on rallies this week. For some time the EUR/USD has been trading directionless, confined to a jobbing range (€1.0650-€1.0750) post April non-farm payroll.

Earlier this morning the 19-member single currency looked on the verge of rolling-over; breaking out of neutral territory, on the back of weaker Euro flash PMI data. With Grexit a potential reality, combined with further weakness at the Euro core, would be considered a potent mix for the EUR bear. Ahead of Euro economic releases, the EUR had teased with stop-losses below €1.0660, but alas, the single unit has managed to provisionally survive the weaker flash data.

The unit has been dragged temporarily higher on favorable rhetoric from Eurogroup head Dijsselbloem repeating more progress on the Greek talks, and by ECB’s chief economist believing that the eurozone’s economy is getting back on the growth track as their monetary policies begin to take hold. Investors should not be surprised that today’s price action could continue along the same vein during the North American session. The EUR bear needs a break of substance through €1.0660 (this week’s lows) to open up the door to last week’s €1.0624 region. Any loss of momentum for the EUR bear is likely to see the market return to the upper echelon of this week’s range, again waiting for any tidbits on Greece.

European and Far East PMI data disappoints

Flash composite PMI data this morning shows that the eurozone’s economy slowed slightly this month (53.5 vs. 54); nonetheless it does continue to grow at a faster pace than in recent years.

To the optimist, it seems the euro economy may be emerging from near stagnation, aided by lower oil prices, a weakening EUR and a stoic ECB. However, the fall in the eurozone composite could also suggest that fears over Greece might already be starting to dampen growth in the region. The composite headline fall reflected decline in both the manufacturing and services components.

The country breakdown revealed a small fall in the German index, but at 54.2 it remains at a relatively high level and is consistent with fairly decent GDP growth for now. But the French composite, Europe’s second largest economy, has edged back towards stagnation (50.2) as export orders fall at the fastest pace in six-months. It seems that the weaker EUR is not offsetting that country’s loss of competitiveness.

Collectively, the PMI data would suggest that the Eurozone could be failing to gather momentum in Q2 and with fears of a Grexit becoming a reality will only raise further the threat of renewed economic slowdown for the region.

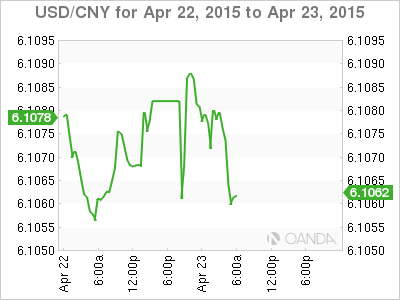

China and Japan Tell the Same Tale

Earlier, leading manufacturing indicators for the Far East also pointed to a difficult start for Q2, as both advance PMI’s for China and Japan showed significant deterioration.

In China, their flash-manufacturing PMI remained in contraction for the fourth consecutive month and even managed to record a new one-year low print of 49.2. Digging deeper, the data reveled that new orders, along with input and output prices, decreased at a faster rate. This would suggest weakening domestic demand and disinflationary pressures. However, it was not all bad news, the employment component continued to decrease, but at a slower rate, while export orders increased.

In Japan, it too has a similar story, as manufacturing PMI fell into contraction for the first time in eleven-months (49.7). BoJ’s Governor Kuroda continues to try and paper over the cracks, talking up the Japanese economy despite the data signaling worsening operating conditions. The Governor sees the economy in “gradual” recovery – even with core-CPI is at +0%, he still sees +2% inflation within reach.

Despite the softening global PMI’s investor’s immediate focus remains on Europe and Greece. The EUR bear will be sitting nervously heading into the North American session, disappointed by the lack of follow through from the softer Euro data. They will be looking to U.S claims and new home sales data for some reprieve. If no immediate relief can be found, expect the weaker ‘short’ EUR positions to come under further pressure as the session proceeds.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.