The Pound hits one month high after job numbers

Tepid U.K wage growth should push rate hikes further out

Dollar Bulls continue to readjust the Fed’s rate hike timing

Global yields continue to fall

U.K’s Prime Minister David Cameron will be happy with this morning’s economic releases. Data released this morning shows that earnings for British workers continued to modestly rise in February (+1.7% y/y, +1.9% expected) amid falling employment (+5.6% vs. +5.7%). Despite the mixed headlines, the conservative spin-doctors will be applying their magic to give Cameron a boost for his reelection campaign. It’s now only three-weeks until the U.K electorate goes to the polls in a tightly fought general election. It will be up to the opposition the rip the reports apart and they will.

BoE rate hike not in sight

U.K Employment rose by +248k in the three-months to February. During that time the employment rate climbed to a new record high which has managed to push the unemployment rate down from +5.7% to +5.6%, its lowest level in seven-years. Analysts believe that the continued strength of the latest job surveys and the further -20.7k monthly fall in the claimant count last month would suggest that the U.K unemployment rate is likely to fall even lower over the coming months.

So, it is not a surprise that wage growth is gradually building. U.K workers are beginning to see their living standards recover, mostly due to the sharp drop in oil and food prices. Despite productivity starting to edge up, the rates of pay growth are probably still not strong enough to suggest that inflation will swiftly return to the BoE MPC’s +2% target. If that is the case, then the likelihood of an interest rate rise within the next year still looks like an outside bet. Hence the reason why fixed income traders continue to push a U.K rate rise further out their curve.

Pound Shorts Being Squeezed

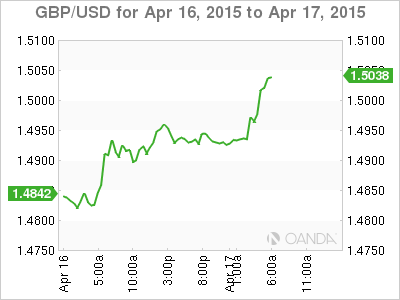

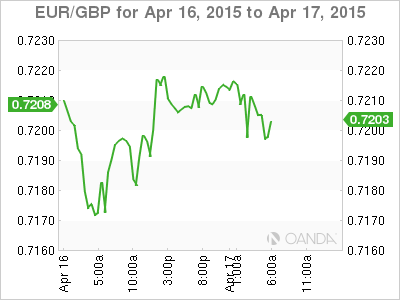

Sterling is being dragged higher for a number of reasons (£1.5035), this morning’s data has obviously helped, there is risk aversion demand and the mighty USD is under performing across the board. The dollar continues to be pressured following a run of softer U.S economic data that has the market readjusting the probability of a Fed tightening as soon as June. Even the probability of September hike has been lowered this week. The softer economic data seems to be creating some uncertainty among the FOMC members about the timing of the liftoff in rates and reason enough for the dollar bulls to be back peddling at the moment. Obviously not helping the dollar’s cause is that U.S Treasury yields continue to fall.

As we head stateside, U.S debt remains better bid this morning. The combination of weak U.S data and the risk-off undertone in Europe is pushing global yields to test record lows. In Germany, out to eight-years, bunds are trading in negative territory. The main benchmark, the ten-year bund trades at +0.11% and it may not be long before investors are “paying away” to own this product as German government debt is considered to be some of the lowest risk globally. U.S ten’s are currently yielding +1.865%.

Inflation data will be the focus of attention in the U.S this morning. The headline is expected to nudge to +0.3% m/m from +0.2% with no change expected to the year-over-year reading. The core-print is expected to remain unchanged too at +1.7% y/y.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.