Street looks to NFP for support

Weak EUR positions beginning to panic

Private Payrolls not necessarily a good measure for NFP

Holidays has liquidity trading at a premium

The pace of the greenback’s rally has been the fastest in over 40-years. For some investors the danger is that the dollar’s move has been too rapid and could be overdone in the short-term. In 11-months, the USD has appreciated +28% versus the EUR. The one directional trade – short EUR positions, has certainly dominated.

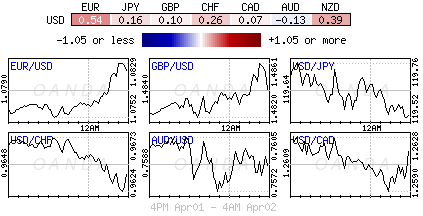

For the first time in awhile dollar trading has been contained to relatively tight ranges across G10 currency pairs. The world’s reserve currency of choice is looking to tomorrows Non-Farm Payroll report to provide the spark to allow the ‘buck’ to kick on and test new boundaries from here.

Weak EUR shorts panic

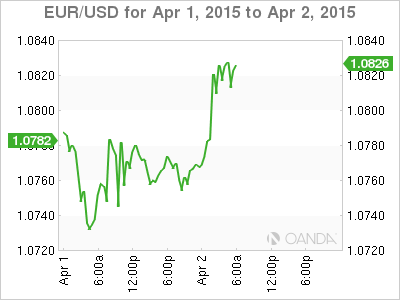

The USD is trading softer (€1.0833) as we head to the U.S open, with a few nervous investors preferring to wade to the sidelines ahead of tomorrow’s U.S jobs report. Trading seems to be dominated by pre-holiday book squaring and not necessarily fresh positioning.

Yesterday’s sub-200k reading of the ADP report, coupled with the depressed ISM employment component, has prompted some concerns that a disappointing payroll report could be a negative surprise to investors and lead to a much deeper USD sell-off. Softer U.S data of late, due to colder weather, could possibly have taken a modest bite out of NFP. The recent signs of weakness in the U.S economy have prompted some investors to push back their bets for the first interest rate hike in the U.S.

The Street consensus is looking at a headline gain of +242k vs. +294k with the unemployment rate to remain stable at +5.5%. The six-month average job increase has lingered just shy of +300k each month, certainly a headline gain that’s not sustainable. A modest surprise should always be expected, but a disappointing report (close to +200k), especially around a holiday weekend, could make things rather messy for both dealers and investors. Good Friday market liquidity will be an issue, especially with a soft report.

Expect liquidity to be an issue

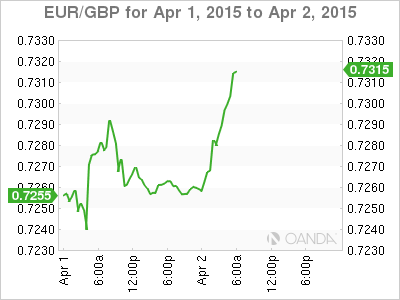

The European session opened with a swift EUR/USD rally triggering stops losses above the psychological €1.0800. Excluding yesterday’s softer U.S data, some of the EUR’s rise has to be put down to the negative comments from one ECB member (Lautenschlaeger) who has been questioning and casting doubts on the effectiveness of the ECB’s own QE program.

Never helping the dollar is the further tightening of US/Bund yield spreads, especially 2-years dipping to their lowest point since the March FOMC meet. Falling U.S yields will always be putting the dollar under pressure. Currently, 10’s are trading near their 2-month low (+1.90%), and U.S 5’s have broken below their recent range lows.

With liquidity trading at a premium expect most investors to try to stay out of trouble, especially as Europe shuts up shop ahead of the Easter holidays. Some EUR price moves will be inexplicable, but until the single unit breaks through the €1.0730-€1.0930 range the market trend remains your friend.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.