Dollar longs again squeezed

Greece running out of funds

Berlin meet needs clarity

Peripheral spreads trade orderly

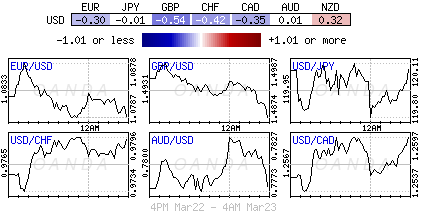

Forex intraday volatility is back with a vengeance. Now that the Federal Reserve is trying to wean investors off the dependency of the central bank it’s making trading currencies are a lot more interesting.

The one-way directional dollar move is not telegraphed, and as before, one has to work a tad harder for their returns. Last week’s Federal Open Market Committee meeting has managed to inject a lot of uncertainty into currency traders’ thinking. Naturally, those doubts will be hardest felt in the most populated of forex trades: euro shorts and dollar longs. They have been the biggest of one-directional bets for many months. A likely consolidation is expected to favor further EUR/USD (€1.1865) short covering.

Fed Talk and Greek Worries Strike Back

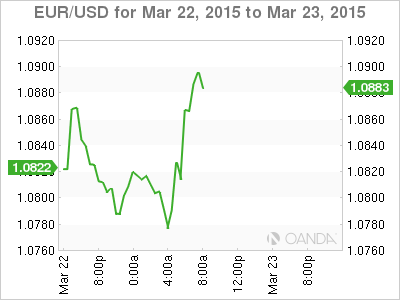

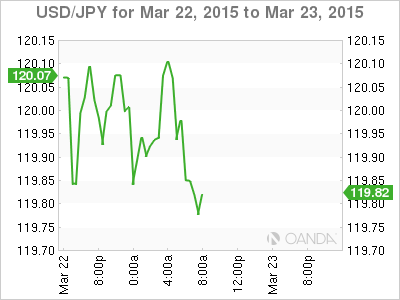

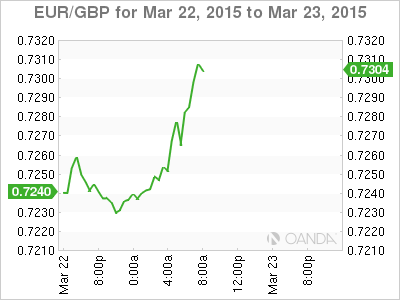

So far on this early Monday morning, the 19-member single currency has seen some fairly whippy trade in the European session (€1.0768-€1.0874). The EUR buying was most likely short covering. St. Louis Federal Reserve President James Bullard’s assumption that the dollar is nearing “fair value” dragged the EUR off its intraday lows. The move to the high end of the range followed Cleveland Federal Reserve President Loretta Mester’s comment that there is room to ease more if the U.S. economy warrants it. From here on in, most investors will be eyeing Greek Prime Minister Alexis Tsipras’s visit to Berlin later today for directional play, as talks on the future of Greece’s bailout continue. Over the weekend, he warned that Greece might not be able to meet impending debt payments without financing help from the European Union.

The EUR, which has been under pressure since quantitative easing was implemented, suffered from a massive cash outflow from the eurozone into U.S. assets. The common currency has since staged a strong recovery from last week’s EUR/USD lows (€1.1464) when the Fed flatfooted the market by indicating that it may not raise interest rates as soon as investors had been expecting. For a considerable period of time the market has been so tightly wound long U.S. dollars, some sort of correction was certainly overdue. The Street got last week’s Fed’s ‘patient’ omission call correct, but was completely surprised that policymakers were not more impressed by the improvements in the U.S. labor market.

Time Ticks Away on Greek Deal

The possibility of a Grexit is the eurozone’s immediate concern. Since Fed Chair Janet Yellen muddied the rate differential argument for the time being, investors have been gravitating back to the amateur theatrics of the Greek government. Athens has led ministerial summits and Eurogroup meetings to fail and now it’s up to the leaders and not the finance ministers to reach an agreement. However, time is running out as Greece is in danger of becoming insolvent. The European Central Bank is unwilling to lift the limit on the T-bill issuance, leaving Greece to raid funds from other domestic sources such as its welfare system and other public funds. It’s reported that Athens may have enough liquidity for roughly two more weeks (April 8), and that Greek finances would be deemed “critical” if the government fails to submit viable reform plans. However, this will not be easy especially with Greece having walked away from the last meeting with a different interpretation to German Chancellor Angela Merkel’s on what was agreed.

Merkel and Tsipras Need to Set Record Straight

This is obviously a priority for both leaders — nothing should be lost in translation. Germany will most likely insist that Greece is to stick to what was agreed to at the end of February. But the Greek government’s humming and hawing is infuriating Europe’s leaders. What is most evident is that the Greek government is severely testing European patience, especially since everyone is still talking about the extension of the original bailout. If the market were talking about the possibility of a third package, capital markets would be trading Grexit risks with a lot more volatility. So far, that is not evident in peripheral spreads despite their being off to a soft start this morning largely just to unwind Friday’s bounce, and also to take some profit ahead of today’s meeting (German bunds/Italian BTP fixed-rate Treasury notes +2.8 points and Spanish bonos +2.5 points).

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.