Euro yields pressure the single unit

Rate divergence has dollar on a global move

September 2003 EUR lows penetrated

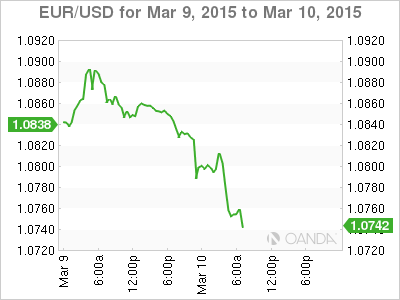

Dealers and investors are happy to walk the 19-member single unit down, and through their medium term target, the September 2003 lows atop €1.0762. There is no fuss, no sense of urgency, just a ‘matter of fact’ move lower for the newly backed QE currency. The uncertainty over Greece and the onset of large scale ECB QE continues to weigh on the EUR. This is allowing the mighty USD to continue to rack up multi-year highs across a number of currency fronts; supported by stronger U.S fundamental data (strong U.S jobs and full-employment) and some hawkish Fed speak.

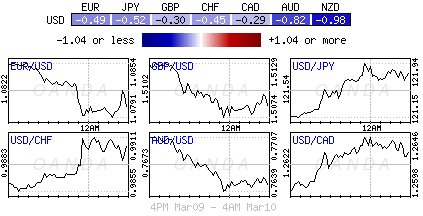

Rate divergence dominates USD move

In the overnight session, the Fed’s Fisher said rates might have to be raised “steeply” if the lift off is delayed and that it’s better to push yields higher “early and gradually.” The Fed meets next week (March 17-18). Expect the market to be firmly focused on the Fed’s communiqué – will “patience” remain or not? Despite Ms. Yellen stating that she will not be held to a rate timetable, investors are looking for any subtle hints that will indicate that June will be the beginning of the U.S tightening cycle and not the fully priced in September meeting.

EUR has no sea legs

Like a hot knife through butter, the EUR has managed to penetrate its long-term medium target with ease (€1.0762). It’s near impossible to stop a runaway train that has momentum on its side, and the EUR backed by the newly launched bond-buying program yesterday continues to squeeze all the positive out of eurozone bond yields. Under QE the ECB began buying government debt yesterday to drive up inflation and boost a fragile economy.

The EUR had already fallen sharply this year as investors geared up for the ECB’s QE program. A percentage of the market had been expecting to witness a EUR relief rally once the QE program officially began this week. That has yet to materialize, the EUR directional play remains all one way and that’s down for now. It’s not a EUR play, but a USD play – it continues to print multi-year highs against the yen (¥122.0) and other majors, commodity and emerging market currencies amid starkly diverging outlooks for interest rates globally.

The negative or low yield scenario throughout the eurozone is not an incentive to want to hold the EUR aggressively. German 10-year Bund yields have fallen to +0.28%, equaling their all time trough. While similar debt maturities in Italy and Spain have hit their lowest yields on record at +1.17% and +1.24% respectively. Investors should be expecting that the renewed standoff between Greece and its creditors over the terms of any fresh bailout deal to push more investors into the safety of government bonds. This will only push yields and the EUR even lower.

EUR Yields – Too Far, Too Soon

One thing to remember is that liquidity issues have been a factor that is supporting lower Euro yields and reason enough to remain negative the single currency. Current liquidity constraints are in fact separating low yields from economic fundamentals. Just look at the German Bund curve. Fundamentally it does not make sense that German 30-year product are trading as low as +0.90%, or lower, but the ECB’s QE and regulatory led demand is pushing the Euro yield curve down. National Central Banks (NCB’s) are able to buy assets with maturities between 2 & 30 years (weighted according to outstanding amounts). NCB’s can buy negative yielding debt up to -0.2% (deposit rate). This will be seen as an incentive to buy other assets rather than just depositing monies with the ECB. When product trades atop of -0.2% only then will market participants become concerned.

Now that the EUR has managed to penetrate its September 20013 target with ease there is technically no support of note ahead of the February 2003 low €1.0665. With the EUR showing little signs of life, investors need to be patient as these moves are a general grind and not an all out race to the bottom. Follow the Euro yield curve for direction. Many expect that ECB QE will compress German rates further, and, with the front end anchored at -0.2% (deposit rate), further yield flattening will occur. The markets next target for 10-year German Buns is +15% and then towards, zero/negative. As German Bunds trade richer, investors will find periphery product that more appealing.

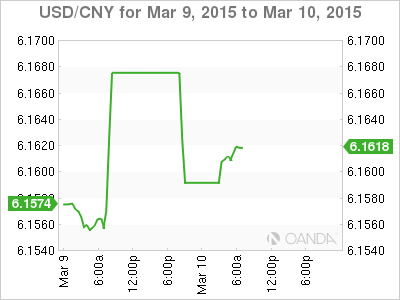

China CPI rebounds from five-year lows

The lack of economic fundamental releases does not make forex directional play any easier. In the overnight session, investors focused on China. Inflation data was the hot topic, coming in mixed with a lower than expected PPI and higher than anticipated CPI. Food CPI contributed to the rebound, rising to +2.4% vs. +1.1% prior, while non-food CPI was up slightly at +0.9% vs. +0.6%. Analysts attributed the increase to holiday factors and a large rise in vegetable and fruit prices. PPI (-4.8%) has now been negative for three-consecutive years, and the decline last month appears to have grown worse. Falling oil refining, chemical fiber, and material costs exacerbated the drop.

Apparently the market is not supposed to worry about China – a couple of PBoC comments were made to reassure the markets. The PBoC expects Chinese CPI to remain in positive territory in the near future, and even pointed to Japan and Europe having larger deflation risks than China. The PBoC also noted that there is “no” risk of a hard landing in China, as economy is stabilizing and improving.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.