Greek list a “valid starting point”

Periphery bonds soar on Greece

Market anticipates a “neutral” Yellen tone

Do we wait for ECB’s QE for lower EUR?

“Be seeing to be doing the right thing” something that Greece is delivering on this morning. A list of proposals submitted by the Greek government on how to overhaul the country’s economy appears to be “in line with the principles” set out by the Eurozone finance ministers. If all the ‘i’s and t’s’ have been dotted and crossed then this could put Athens one step closer to securing that four-month extension to its €240b bailout, which expires at the end of the month.

The Greek government needs its creditors to approve its proposals to secure a four-month extension to its loan agreement. Eurozone finance minister are expected to hold a conference call later this morning to discuss the measures, and if they pass, approve the extension. The reform list supposedly commits to reforming tax policy; fighting evasion, eliminate incentives for early retirement, review privatizations that have not been launched, and to reform public sector wages. A lot of this is nothing new, but it’s a commitment that Greece has to entertain at the very least.

Initial market reaction has Greek bonds soaring. The government’s 10-year benchmark is down nearly one percentage point at +9.03%, the lowest in a month. Perhaps more impressive is Greek short-term product, which are highly sensitive to default risk, are down more sharply with two-year debt falling three-percentage point at +12.9%.

For the foreseeable future Greece is expected to remain in the limelight, with “Grexit risk” only simply subsiding as opposed to having been wholly eliminated. For many, contagion risks will remain contained as investors and dealers become comfortable to the risk with additional help coming from ECB’s QE expectations.

Market hedging on a neutral tone

The consensus has Fed Chair Yellen striking a “neutral tone” at this week’s Humphrey-Hawkins testimony. Nevertheless, both investors and dealers will be looking for any clues to perhaps upset the apple cart. Any extra emphasis on low inflation versus strong labor market will be important, it could change the end of any day outcome. The majority believe that a Fed lift off on rates at its June meeting would almost be assured if it were not for the oil driven slowdown in inflation. Nevertheless, the Fed’s focus on “core-inflation” certainly will give U.S policy makers some latitude to see through the energy related noise.

It’s a fine balance act that the Fed is trying to walk. U.S policy makers are trying to preempt the non-accelerating inflation rate of unemployment (NAIRU – refers to a level of unemployment below which inflation rises). However, making it difficult are U.S jobs numbers. The absolute strength of the U.S jobs data in the past few months (three-month average +334k) means the Fed probably cannot wait until inflation is closer to target. Some hawks at the BoE are arguing along similar lines as late as this morning. Only a sudden jobs slowdown would dissuade the Fed from pressing ahead with lift-off and a normalization rate policy. The Fed and UST yields should soon be supporting the USD again.

U.S treasury yields are marginally higher as the market waits for Yellen’s semi-annual testimony. It will be interesting to see what happens from here. This month saw a reversal in U.S rates, 10’s have rallied (higher yield) a little under +50bps in less than a month. For investors and dealers, it will be interesting to see whether Yellen alters the message much from last month’s FOMC minutes which the market took as been broadly “dovish.”

What’s going to push this EUR lower?

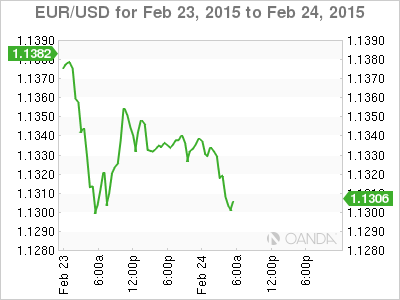

Investors fear being led astray and remain far more comfortable staying close to home waiting on Ms. Yellen and her Humphrey Hawkins testimony. The single unit continues to hug the lower end of the today’s range (€1.1300) despite some positive remarks from various Eurocrats on Greece. Grexit seems to off the table, temporarily at least as Greece gets serious regarding commitments. The EUR seems to be at the mercy of today’s supposed vanilla option expiries (€1.1285-1.1315 around €3b’s worth). With little incentive, traders are expected to remain happy sitting on the sidelines ahead of Fed’s testimony. The market should be expecting the hedging of expiries to remain the dominant flow, at least until Ms. Yellen give market guidance.

Excluding the problems of Grexit, Russia/Ukraine and terrorism, what can possible push the 19-member single unit lower? As the start of the ECB’s government bond purchases draw closer, the obvious question is who will sell government bonds? Currently, the most likely candidates are investors from outside the eurozone, as they are generally likely to be discouraged from holding euro-dominated assets due to low (or negative) yields. FX reserve managers may have a lower propensity to sell given their focus on government securities for liquidity, capital preservation and reserve diversification. Beyond them, domestic retail investors and non-bank financials are the most likely sellers.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.