Singapore’s MAS flat foots market

CB want to recalibrate rate policies

FED to change record?

Can the “big” dollar be contained by FOMC’s decision?

Central Banks that are unwilling to commit to something monetary, either action or verbal, are in danger of keeping their own domestic currency’s supported. Monetary authorities are in the midst of a currency war whether they want to be or not. The proactive and aggressive bankers are successful manipulating their currencies lower; the reactionary policy makers are being exposed. This month has seen verbal (RBA), QE (ECB and BoJ), rate cuts (BoC) and negative deposits all being used (Danmark’s Nationalbank, SNB) to weaken the appeal of various currencies and eventually help those countries foreign exports.

Rate policy recalibration

It’s not just the “big boys” who are managing to make some waves. The ECB with its QE is pressuring Tier II CB’s to adjust their policies accordingly or be left behind. Most of the decisions are not necessarily a complete surprise, but the timing of implementation is taking the market by surprise. However, there are a few Central Bankers weary of losing credibility and prefer to proceed with caution.

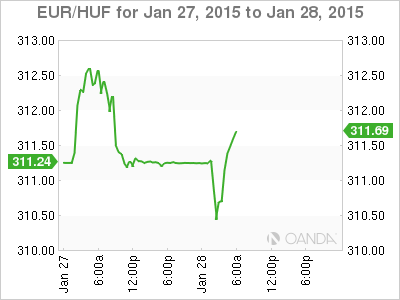

Yesterday, the Central Bank of the Republic of Hungary (MNB) had no room to cut rates (2.1%) as to do so would have eroded its “credibility.” This is in total contrast to the SNB and Jordan’s actions a few weeks ago. Despite the SNB’s credibility in policy setting having been tarnished after the franc flash crash, the central bank’s reputation in aggressively acting on FX and interest rates will always be feared by the market. Yesterday’s market rumors that Swiss authorities were intervening had the EUR bear rapidly unwinding various ‘short’ EUR positions, allowing the single unit to move further away from its 11-year outright lows (€1.1098). Hungary’s MPC is not “keen in surprising financial markets” by delivering a rate cut without prepping the market first. The Central Bank kept its forecast unchanged at a flat rate by the end of March 2016. They will wait until the MPC gives some official indication that they see room to reduce the base rate. The fixed income market, using FRA’s (forward rate agreements), expect the base rate to fall to +1.75% within six-months.

A primary objective of various policy makers’ is to try to keep the market abreast of Central Bank thinking. Capital Markets are not very fond of the unexpected, especially when it comes to monetary policy. The Fed and BoE’s more transparent approach seems to be far more appealing to investors. Nevertheless, investors are now more aware than ever about global rates, regional inflation and monetary policy. Over the past 12-hours alone various Central Banks prefer being “front and center” and are very willing to keep the markets well informed.

CB’s up to date

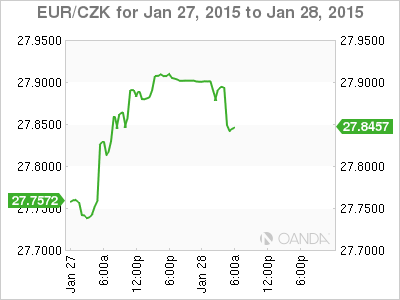

The CNB or Czech National Bank indicated this morning that disinflation pressures were coming from abroad, and that domestic economic growth and rising wages were starting to generate slight price pressures. The Bank of Thailand noted that it decision to keep policy steady was again not unanimous (vote was 5 to 2). It reiterated that interest rates remained accommodative for growth as the economy continued to recover aided by lower oil prices (Q4 GDP seen improving q/q). Inflation could break lower end of target but was not seeing as deflationary. Policy makers have also indicated that its key rate was not the main factor for “capital” flows and that they would use other tools to manage capital flows.

Malaysia’s Central Bank, Bank Negara Malaysia has stated that their monetary policy remained accommodative and saw sufficient liquidity. Policy makers have noted that 2015 inflation to be lower than previously expected.

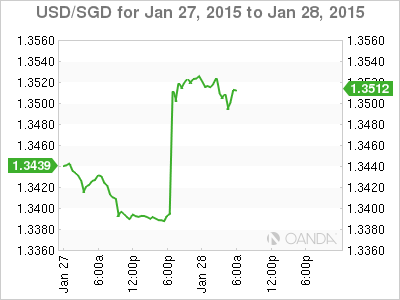

MAS flat foots the market

The overnight surprise came from Singapore’s Central Bank (MAS). They eased its currency policy to fend off deflationary pressures. Authorities reduced the slope of SGD’s nominal effective exchange rate appreciation to around +1%, which in effect is an easing of monetary policy. Last nights decision leaves the door ajar for another potential ease of the SGD NEER at the next “official “announcement in three-months. Outright, the SGD lost close to -1.5% to the USD and is expected to make further inroads towards the SGD$1.39-1.40 handle over the coming months.

Can Yellen afford a change?

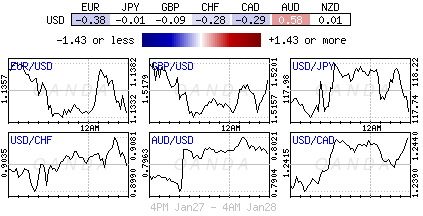

Apart from the above currency moves the USD is little changed as Capital Markets head stateside. Investors seem to be happy to wade to the sidelines ahead of today Fed policy announcement (no post-press conference). Currently, it seems that consensus are expecting modest changes to the statement, including a possible removal of the “considerable time” chant. The market will be looking for clues on whether the Fed will loose its nerve to hike mid-2015?

The Fed had been expected to begin raising rates this summer, obviously backed by the U.S’s underlying strength. But it’s not as clear-cut as before – analysts and investors are raising doubts, supported by some softer domestic data (yesterday’s horrid consumer durable headline -3.4%) and a deflationary global backdrop. The next two-months of U.S data are important as a signal for a June hike. All the markets want is a heads up that the FOMC is about to deviate from its path of hiking overnight interest rates. Any clues, hints or innuendos that a rate hike is being pushed further down the curve will halt the “big” dollars advance in a hurry.

Yellen and company needs to continue to support their transparent monetary approach. The market should be expecting policy makers to continue to take baby steps in achieving their objective of policy normalization.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.