EUR/USD has posted gains on Tuesday, recovering from losses sustained a day earlier. In the European session, the pair is trading slightly above the 1.25 line. On the release front, German ZEW Economic Sentiment climbed to 11.5 points, while Eurozone ZEW Economic Sentiment followed suit, rising to 11.0 points. In the US, today’s highlight is US Producer Price Index, a key inflation indicator. The markets are expecting another weak reading, with an estimate of -0.1%.

German investor confidence soared in November, as ZEW Economic Sentiment rose to 11.5 points, compared to -3.6 points in the previous release. This crushed the forecast of 0.9 points and marked a 4-month high for the key indicator. It was a similar story with Eurozone ZEW Economic Sentiment, which jumped to 11.0 points, easily beating the estimate of 4.3 points. The thumbs-up from investor confidence followed the news that Germany had avoided a recession with a small 0.1% gain in GDP in Q3.

ECB head Mario Draghi and his colleagues are under strong pressure to “do something” to kick-start the weak Eurozone economy. Deep interest rate cuts haven’t had much effect, so the ECB has purchased covered bonds and asset-backed securities. So far, these securities have been from the private sector, and the ECB could decide to expand these purchases to government bonds, known has quantitative easing. However, there is resistance to quantitative easing from national central banks, such as the powerful Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that further stimulus measures could include government bonds.

US consumer indicators looked strong on Friday. Retail Sales and Core Retail Sales both posted gains of 0.3%, edging above the estimate of 0.2%. UoM Consumer Sentiment continued its upward trend, climbing to 89.7 points in November. This was the indicator’s strongest performance since July 2007. Meanwhile, US Unemployment Claims has looked solid in recent readings, but the key indicator jumped to 290 thousand, missing the estimate of 282 thousand. This marked a seven-week high for the key indicator. The news wasn’t any better from JOLTS Jobs Openings, which weakened to 4.74M, down from 4.84M a month earlier. The estimate stood at 4.81M.

EUR/USD for Tuesday, November 18, 2014

EUR/USD November 18 11:20 GMT

EUR/USD 1.2518 H: 1.2538 L: 1.2449

EUR/USD Technical

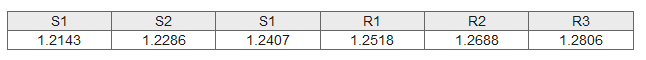

- EUR/USD posted gains in the Asian session. The pair continues to move higher in the European session and is testing resistance at 1.2518.

- On the downside, 1.2407 is a strong support level.

- On the upside, 1.2518 is fluid and could break during the day. 1.2688 is the next resistance line.

- Current range: 1.2407 to 1.2518

Further levels in both directions:

- Below: 1.2407, 1.2286, 1.2143, 1.2042 and 1.1875

- Above: 1.2518, 1.2688, 1.2806 and 1.2905

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.