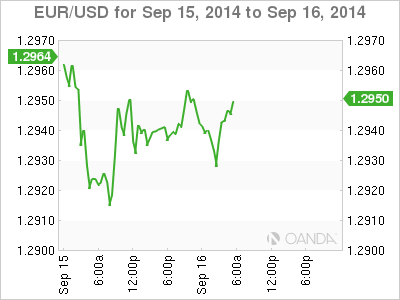

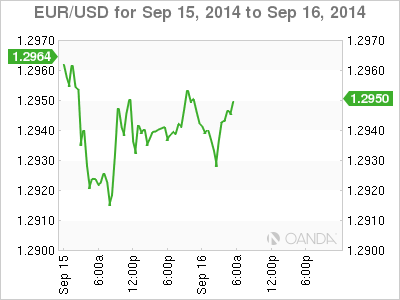

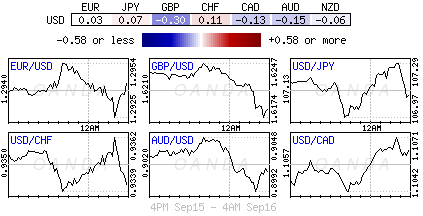

The dollar remains King. It has risen against a broad basket of currencies for nine-consecutive weeks and so far has completed its longest winning streak in 17-years. Will the Fed end its winning ratio or is it to be a temporary blip before pushing on to greater heights? Many expect the greenback to continue its rally, hitting €1.20 against the EUR by the end of 2015, driven mostly by the cyclical strength in the U.S. economy as opposed to Europe.

The 'single' unit will have to battle various structural macro-disadvantages and most importantly, the growing divergence in central bank monetary policy. A fear of the Fed taking a more hawkish stance at its two-day FOMC meeting that concludes tomorrow is keeping both European and U.S. bond yields elevated. U.S. policymakers are expected to shed some light on plans to raise interest rates. Despite policy makers having a habit of disappointing, the recent uptick in the dollars interest is a massive boost to both volume and volatility and hence opportunity for investors.

Celtic Pride plummets pound

Despite Central Bank rhetoric dominating directional flows across the various asset classes, its 'nationalism' that is pounding sterling. Scottish referendum fever continues to grip market price action, and though the odds for the country to vote to leave the U.K. have lessened, sterling's fate rests on Thursday's vote. The pound remains under renewed pressure this morning (£1.6178), as the market suffers with last minute nerves with a too close to call vote on sovereignty. There is a belief that the market is a tad too complacent in pricing the possibility of a "yes" vote - in favor of independence would probably weaken the GBP by a further -4 to -8%. Making it difficult for investors is the Fed. If Ms. Yellen and company happen to be hawkish or "less" dovish tomorrow will certainly put the pound firmly on the back foot along with the remaining majors, as US rate divergence trumps all.

Despite the 'toing and froing' in opinion polls, the U.K. bookies report that the "no" wagers outnumber "yes" by three to one - this would suggest that the danger to sterling remains to its left-hand-side. So far this year, it has lost -2.5% in value to the dollar and even a close vote will bring its own repercussions - just ask Canada about Quebec, it took years for the question to go away while driving business out of the province and hurting the Canadian economy. Official results will be made known on Friday and the outcome remains too close to call.

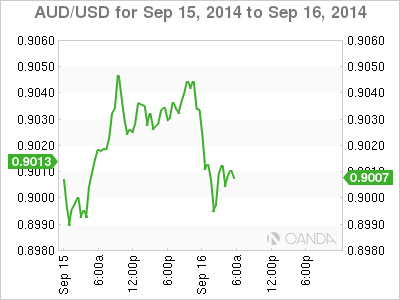

RBA find new pet peeve

Aussie policy makers rarely mince words, this time on the release of RBA policy meeting minutes overnight, they renewed their concerns over the risks of rising housing prices. The RBA has warned of speculative demand in the country's real estate sector, triggered by record low interest rates, signaling that further monetary policy easing is unlikely in the near term - on September 2, Governor Stevens kept interest rates at +2.5% for the thirteenth straight month. Like other prudent Central Bankers, the RBA is worried that Aussie macroeconomic stability would be in danger and that speculative demand (instigated by Asian interest) increases the probability of a free-fall in prices. There is a flip side, many do not see a substantial risk in the sector and that Australia should produce more housing given the demand. Even economic growth, which is expected to recover next year given some encouraging recent trends in employment, would be expected to absorb most new development.

The AUD made a feeble attempt to rally today (AUD$0.9050), supported by the RBA's growing concern about housing prices and the uptick in iron-ore prices. Nevertheless, the rally is fleeting at best, as the Aussie is currently making an assault on the psychological AUD$0.9000 handle. Despite the diminished expectations of another rate cut, the AUD faces downside risks from a plethora of outside forces - the massive unwinding of the "carry" trade fueled by Fed rate divergence and accompanied by softer Chinese data. Currently, the AUD is expected to make another assault on Monday's six-month low (AUD$ 0.8984). Many investors will want to wait for the Fed tomorrow to support current convictions.

EUR along for the ride

The EUR has been contained or even supported by "carry" trade unwinds or EUR/GBP buying. Both of these trades had become very crowed in recent months and currently the focus is not directly on the EUR but the Aussie and Sterling. Even this morning's German ZEW has had little direct impact on the 'single' unit despite it coming in slightly better than the 4.8 that was expected with a reading of 6.9 compared with 8.6 previously. It is the ninth consecutive month that the index is lower, but the rate of decline has slowed. The current condition index is much lower at 25.4 compared to 44.3 previously, obviously weighed down by geopolitical risk concerns and the fallout of EU/US Russian sanctions. The market remains a comfortable seller of EUR on rallies with offers reported between €1,2965-75 and stop-losses just above the option reported €1.3000 level.

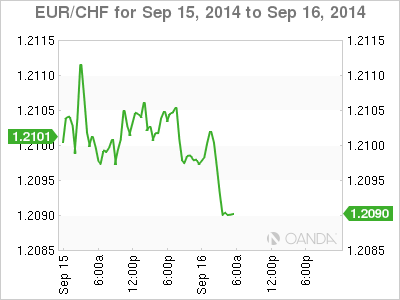

Many investors would be better served perhaps focusing on the CHF rather than the EUR outright this week as the 'single' unit remains at the total mercy of other currencies. After the ECB, the SNB could be the next up to introduce negative interest rates. They next meet on Thursday as the EUR/CHF cross has dropped below levels where the SNB has sought to hurt speculative positioning in the past. Swiss policy makers have the option of moving the €1.2000 floor, but why mess with something that seems to be working and replace it entirely with something that is unproven?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.