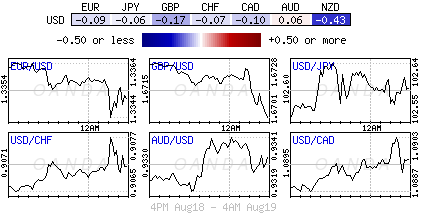

Currently, the Central Banker remains at the 'core' for most of the forex moves. Governor Stevens at the RBA is trying hard to jawbone his own currency, the Aussie dollar, lower. While the 'chameleon' Governor Carney at the BoE seems to be confusing investors with some hawkish weekend copy, combined with dovish comments delivered last week, is complicating the pound's direction this week. Thrown into the mix an MPC dissenter or two, and if nothing else, policy makers are certainly providing investors with price movement opportunities.

Even stateside, the investor is looking to the policy maker for guidance. The FOMC will release the minutes from its last meeting later this afternoon. Expect the market to downplay the event; instead dealers prefer to look to the annual symposium on monetary policy in Jackson Hole this Friday for market direction. The FOMC minutes will certainly indicate what happened a few week's ago, while Jackson Hole will hopefully give the market some clues on any "future" Fed policy shifts. Both events will have investors looking for clues as to when the Fed will start hiking interest rates. But, the "real" look ahead for any hints as to monetary policy is Jackson Hole.

BoE discord reigns

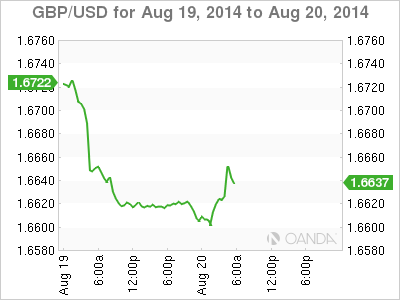

Are the cracks finally appearing? UK data this morning indicated that two MPC officials pushed for an immediate interest rate rise in August. The MPC minutes indicated that Martin Weale and Ian McCafferty voted to increase the BoE's benchmark to +0.75% from its "three"-century low of +0.5%. Their actions officially mark for the first time dissent within Carney's ranks. The possibility of rate divergence amongst the majors will increase market interest in sterling. Today's reports will both heighten and fuel speculation that the BoE might raise rates sooner than expected. Already the market is pricing in a rate hike in Q1 2015, a week after Governor Carney threw cold water on an earlier November hike by focusing on wage and labor spare capacity. Nonetheless, will investors now revert to their earlier prediction of a BoE rate hike by year-end?

The news of the dissent has only been able to give GBP/USD a modest boost (£1.6650) and that's because the aforementioned dissenters are well known 'hawk's.' They both will find it difficult to sway the rest of Carney's rate-setters. The minority convincing the majority is not an immediate threat. If anything, sterling's strength is also been hampered by the 'big' dollars move higher across the board. Carney and his rate-voting followers will hold on to the fact that there is insufficient UK inflationary pressures from anemic wage growth to justify an immediate rate hike. If the market does buy into this theory then the pound should continue to follow along its bearish trend a little while longer.

Steven's gets his second wind

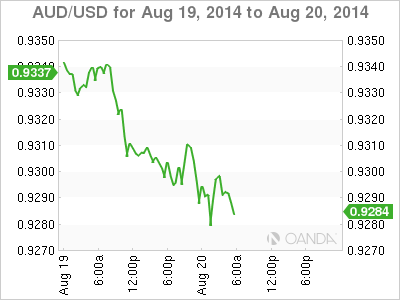

Governor Stevens at the RBA is getting a lot of practice to jawbone his currency lower. He seems to be using every opportunity to talk his currency down despite some mixed fundamental messages. Overnight, he mentioned the possibility of Central Bank intervention to weaken the AUD ($0.9290) and that the chance of a "significant drop in the Aussie dollars value remains under appreciated." Steven's has been very vocal on how an expensive AUD is hurting their exports, especially manufacturing. The RBA has the option to use direct intervention, it's a part of their "toolkit" and it's an option that is on the "table" and one that requires to be telegraphed to the financial community to improve its effectiveness.

In an environment handcuffed by CB's "low rate" policies, the AUD has benefitted from the go to "carry" trade, mostly financed with investor's borrowing in EUR's (low financing cost) and buying the higher yielding currency - the AUD. Nevertheless, the moment that the Fed indicates a change in their monetary policy, these "long" AUD/carry positions should come under some severe pressure, mostly because it's a very "crowded" trade. The AUD continues to trade well north of the psychological $0.9000 cent level despite sharp falls in key commodity prices and the RBA cutting its estimates for growth and inflation. Obviously, most of the Aussie's strength has come from foreign capital flows. Australia issues approximately AUD$55b new debt each month and with foreign investors strong demand for yield will continue to support the AUD on pullbacks.

The 'real' AUD direction is being fought by rate differentials. There is only so much policy "talking" that can weaken the currency. A weaker AUD requires a change in monetary policy to have a greater impact.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.