The forex market has had a little bit of everything thrown at itself over the past 24-hours. It looks like an asset class that wants to make up for lost time in a hurry. Finally, fundamental and technical themes are beginning to join the dots that both 'volatility and volume,' in the current low rate environment, had been missing.

It's simple; all that investors' want is the opportunity for price movement. From Argentinian sovereign debt defaults (albeit brief), to +4% US GDP growth reports, to Euro unemployment surprises and ongoing deflation concerns, to Fed dissenters, to geopolitical risk, this market has a plethora of reasons to get involved and change their tact for the remainder of this year. Tomorrow is Non-Farm Payrolls (expected +230k, +6.1% unemployment rate) - will the report stick to the consensus headline script or will seasonal factors blow expectations away? If nothing else, this week has already been able to bring enough surprises for investors to consider changing some of their longer-term strategies or get burnt later.

Fed stays the course

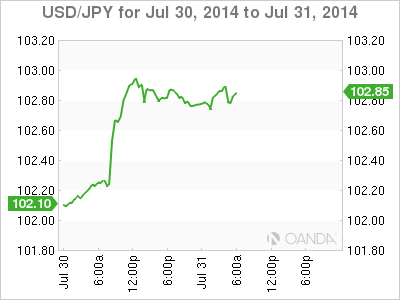

Much higher than expected US GDP (+4% vs. +3.1%) and incrementally more 'hawkish' statement from the FOMC has managed to push US treasury yields up, leading to a stronger USD, and slightly lower precious metals prices. US 10's have succeeded in backing up +9bps to +2.54-5% territory, USD/JPY has briefly tested the psychological ¥103 figure, while December gold futures are down for the fourth consecutive day at $1,295.

To date, the Fed has been very transparent in signposting their intentions. The market expected the ongoing commitment to taper, while continuing to scour for clues on rate hike timing, which obviously depends on the Fed's interpretation of stronger data, especially in the labor sector. On the whole, no real surprises, but the Fed's been squeezed by both the market and fundamentals and is required to tread carefully.

Yesterday, Fed's Plosser was a lone dissenter on the committee, voting in favor of keeping the "considerable time period" clause in the statement, even as the Fed acknowledged further declines in unemployment in spite of continued "underutilization of labor resources" or in other terms spare capacity (a phrase infamously being used by most CBanks). On inflation, the statement noted that it was somewhat closer to the Committee's longer-run objective, and the likelihood of inflation running persistently below +2% has diminished somewhat (dealers will be looking closely at tomorrows PCE index - the Fed's preferred inflation gauge). As expected, the Fed tapered QE by another $10B to $25B per month. If they want to finish taper by October they will need to up the ante in taper amount, as there is only two more meetings.

'Less' Dovish Favors Dollar

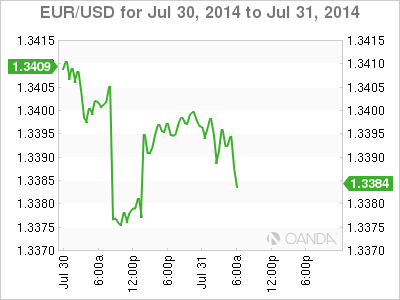

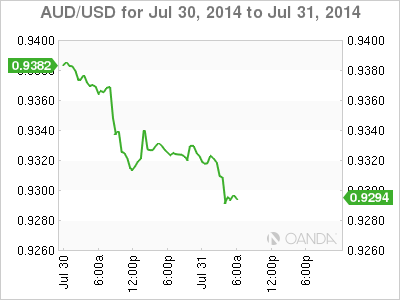

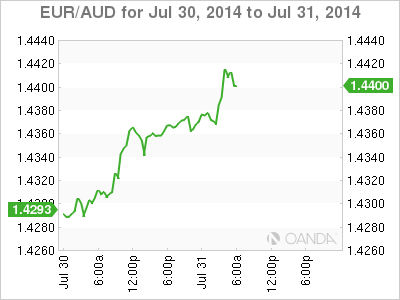

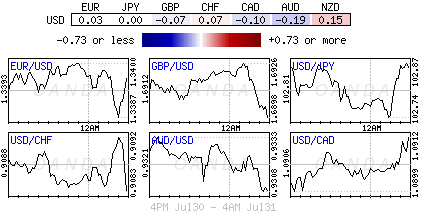

It's no surprise to see the dollar trade higher across the board (AUD sub $93c, EUR through €1.34, JPY eyeing ¥103) and gather momentum as US yields back up. With the Fed continuing to shift to a 'less' dovish policy is and should provide a more supportive stance for the dollar for the remainder of the year. Nevertheless, the markets will want to take a timeout and catch their breath ahead of tomorrows "granddaddy" of economic releases - non-farm payrolls.

In catching its breath, this morning's expected lower "low" on Eurozone headline inflation is not having much of a market impact on the single unit (€1.3385), nor are tumbling Euro bourses. The headline +0.4% print was already mostly priced in, and the core inflation rate remaining steady at June's +0.8% is not an influencer. The Euro's problem remains with the peripheries; Spain's -0.3% m/m prints and Italy's y/y flat rate (vs. +0.2% expectation) would suggest ongoing deflation concerns. Nonetheless, Draghi and company will not be rushed to act, not at least until they can gauge the impact of the TLTRO program (targeted longer term refinance operations). Record low Euro yields and the German Bund "bull flattener" combined with the EUR's ongoing weakness would suggest that the market is already happy to do the job of loosening policy for the ECB.

Argentina is in a technical sovereign default after not paying its debt holders by yesterday's deadline. Currently, there is no EM fallout from non-payment for a number of reasons - the risk was long expected and more importantly, Argentina has long been isolated from Capital Markets after the 2001/2 defaults. Obviously their situation will only make the country's severe economic problems even more difficult. By day's end, Emerging Markets are more sensitive to a rise in US treasury yields on solid economic data. Will tomorrow's US jobs report put the squeeze on yields again?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.