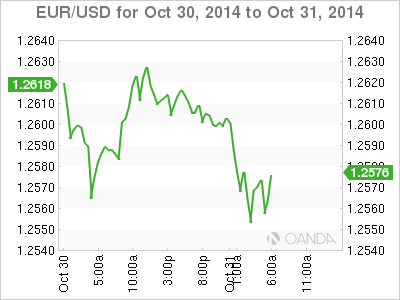

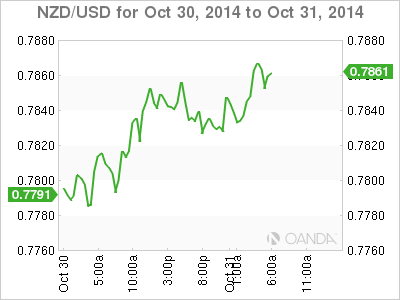

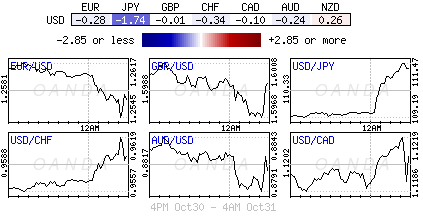

The forex space has been waiting a long time for a plethora of monetary and policy reasons to once again ignite currency moves. For too long, CBanks no-nonsense, low rate approach had been curtailing currency ranges. The Fed’s end to tapering this week supported the buck as investors focused on a robust U.S labor market and not the potential for higher rates. The RBNZ dovish remarks have the Kiwi underperforming and finally, the BoJ’s overnight actions have again side swiped the market – all three have contribute to an interesting closeout to October. The net result has been a stronger dollar mostly across the board, higher equity prices and a spike in U.S yields.

Most things look rosy for the U.S. Even yesterday’s Q3 GDP (+3.5% q/q) data shows that the U.S economy continues to lead the global recovery. Despite deflationary challenges in the eurozone, and slower growth concerns in the emerging markets (China, Brazil and Mexico), the US has managed to register two consecutives strong quarters (Q2 +4.6% and yesterday’s +3.5%). Forever, the disappointing print in Q1 this year (-2.1%) will continue to be attributed to “transitory” factors.

U.S Government spending distorts

The initial market reaction painted a healthy-looking picture, nevertheless, digging deeper into the numbers, the big gain in government spending was responsible for much of the outperformance, while the fixed investment, exports and imports all declined. Federal government spending broke a long string of declines by growing at a 10% rate in the quarter. Nevertheless, global investors continue to see the U.S as the global economic beacon while other regions continue to struggle.

CBanks again dominate the landscape this week and next. In mid-week, the Fed surprisingly focused on the “robust” U.S labor market. This could suggest that Ms. Yellen and company is trying to prep the market for a bigger change in December. One of the responsible roles for any central banker is to ease into a significant policy change. This helps policymakers eliminate any surprise shocks that could potentially harm an economy. The Fed does indeed need to get the market primed and ready for an eventual rate hike. The fruits of their labor are beginning to show with FI beginning to price in the first rate hike sooner than later.

After the Fed it was the RBNZ and they too flatfooted the market. Governor Wheeler kept Kiwi rates on hold at +3.5% for the second consecutive meet, but removed policy maker’s bias in favor of more tightening in light of the softer-than-expected inflation pressure. New Zealand inflation has slowed more than expected in Q3, hovering close to the bottom of the RBNZ’s +1-3% desired range. The RBNZ indicated “a period of assessment remains appropriate before considering further policy adjustment.” It was only natural that the NZD would come under pressure with the dovish tone (NZD$0.7846).

BoJ does it “my way”

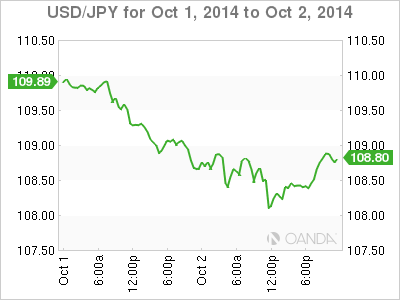

By dropping no hints of imminent action, instead playing down doubts over Japan’s economic price prospects has allowed the BoJ to be able to spring the biggest of Halloween surprises. Governor Kuroda likes to shock, as he is looking for the markets biggest impact. Overnight, the BoJ unexpectedly announced additionally stimulus measures which includes upping its asset purchases total to ¥80-trillion from the previous ¥60-70-trillion target range. This is the first time in 18-months that Japanese policy makers have bolstered its asset purchases; especially as its +2% inflation target looks increasingly unattainable.

The BoJ lost its way ever since April’s consumption sales tax was introduced. The net result of a tax hike has only dampened consumer spending, further hindering the economic problems of the world’s third largest economy. Interest rate divergence (US “less” dovish, Japan dovish) is expected to have broad implications for investors and the market. With the BoJ moving in the opposite direction should benefit Japanese exporters by weakening the Yen further against the dollar (this week the yen has weakened from ¥107.65 to this morning’s ¥111.65). The news has sent the Nikkei benchmark to print a seven-year intraday high, while the dollar continues to find support.

Governor Kuroda indicated that they have not run out of ammunition. He firmly rejected the notion that there is little the BoJ can do if the rate of inflation again defies policy maker’s objections. Perhaps more importantly, Kuroda insisted that the BoJ has not shifted back to an “incremental” policy change. Yesterday’s large policy expansion is considered a “pre-emptive” strike to hit the +2% inflationary target sooner, it’s not about a weaker Yen aiding exporters, nor has anything to do with Abe and raising the national sales tax next year – it’s all about hitting the +2% inflation target a tad earlier – it’s a large reasoning pill for the markets to swallow!

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.