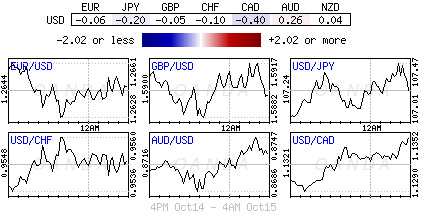

The USD continues to recover after the Federal Reserve Minutes took the wind out of its sails last week. Lower industrial production out of Japan (–1.9%), a flat German CPI (0.0%) were USD positive releases this morning. Even though the European Central President spoke at an event, Mario Draghi stuck to the matter at hand. Speaking at the Statistics Conference in Frankfurt the ECB president he outlined the importance of the continuing integration between the central bank regulatory functions and the data. The market is awaiting the US Retail Sales figures to decide if the USD will continue to recover versus the EUR and other major currencies.

The Swiss ZEW report came in way under expectations at –30.7 with a previous print of –7.7. The survey measures the optimism of analysts and investors at large institutions for the next six months. A reading above 0.0 is optimistic. This drop follows a similar negative move in the German ZEW survey fell yesterday into negative territory. Two european powerhouses are beginning to show that they are not immune to the economic ill that have ailed the rest of Europe. Chronic low inflation and geopolitical turmoil in the continent have taken its toll. The German government yesterday cut its growth forecast for this year from 1.8% down to 1.2%. If the engine of growth in the eurozone is stalling there are big question marks on how the member of the european union will react and take appropriate actions to spark growth and beat deflation. The main reason holding the ECB from releasing further stimulus into the EU’s economy is the lack of agreement from member states on the size and nature of the measure that will be taken. The ECB has done its part, and now the european commission will have to mediate to reach a compromise between divided factions.

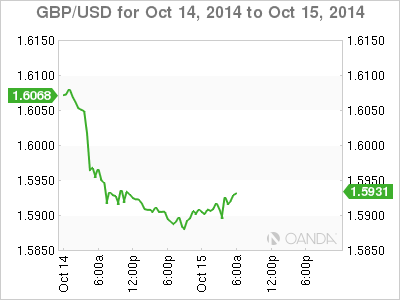

Slow inflation is keeping to the GBP on the back foot versus the USD. UK inflation growth is at a 5 year low and the GBP/USD pair is back close to 1 year lows. Inflation is a key indicator given the Bank of England’s plans to hike rates in the mid term. If there is no or low inflation it would be premature to raise rates as the growth of the country would be compromised by falling prices and higher cost of credit which would have a compounded effect on consumption. The US Federal Reserve continues to have the lead as the most likely central bank from the major economies to raise rates. The BOE had a strong string of data earlier this year, but comments from the central bank governor and disappointing data keep pushing back the data of an actual rate rise.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.