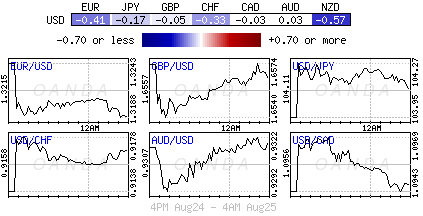

A slight of hand, a change of heart and CBanks policy makers are about to change the rulebooks on monetary policy. To date, the forex market has been cocooned by a G10 low rate monetary policy resulting in a "low volume, low volatility" trading landscape. It would seem that the squeeze is on Central Banks to change their policy to stay ahead of the curve. The diverging Central Bank views out of Jackson Hole favors further the bullish USD trend, especially now that Fed chair Yellen language is seen as moving towards "neutral," the ECB is seen moving closer to QE after Draghi acknowledged the weakened inflation outlook (German 10-year Bund at fresh record low - below +0.95%) and the BoJ Governor Kuroda conceded that they might have to pursue its aggressive monetary policy easing for longer period

For the BoE, the question has always been about 'when' they will hike; especially now there is dissent amongst Carney's rank and file. From the Fed's perspective, it is clearing their own runway, while at the same time talking through the whole process in detail with dealers and investors alike. The toughest task, and the two entities that are the most vulnerable, is the ECB's President Draghi and the Bank of Japan's Governor Kuroda. The BoJ is going to try and talk its way through its economic problems and is considering using more upbeat language to describe the state of the economy, suggesting that it does not see the need for any immediate action, to give "faltering growth a shot in the arm." The ECB on the other hand does not seem to have the same luxury as Japan. In Draghi's speech last Friday's in Wyoming he insinuated that the ECB is about to change tact.

ECB to switch directions

ECB's Draghi has called for a departure from the austerity-focused mind-set that has dominated Eurozone policy making - it's not really working, as Euro officials continue to grabble with stagnating growth and disturbingly low inflation. Focusing on the recent slump in long-term inflation, Draghi insisted that the risks that the ECB "doing too little" outweighed those of "doing too much." The market has interpreted his comments as meaning that broad-based asset purchases or quantitative easing (QE) have become more likely and necessary.

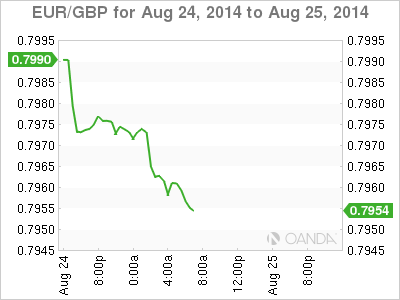

Draghi's comments that Euro-policy makers will "use all the available instruments needed to ensure price stability" is extending the QE market bid this morning and this despite the UK long holiday weekend and the last week of August. Italian 10-year BTP's (generic debt paper) futures have rallied a whole point and are leading the cash markets. Regarding spreads, Bund/Italian debt has tightened -4bp to Bunds, which suggests that intraday dealers are bidding the market up as they grab the most liquid of instruments (Italy is one of the largest fixed income traders in the world and the third largest economy in Europe). Bono's (Spanish bonds) are doing even better, the 10-year benchmark to Bunds are -5bp tighter, probably reflecting the investors greater comfort level for Spanish debt and the fact that Italy does have mid week supply to content with. Draghi's comments last week mark a significant turning point to the ECB's rhetoric. A program of QE, along the lines of the BoE or the Fed will continue to support both bond and equity markets while applying pressure to the 18-member single unit (€1.3197).

German data typifies current headwinds

An indicator for German business confidence fell more sharply than expected earlier this morning. The German Ifo business climate index fell to 106.3 from 108, indicating that Europe's strongest economy has gotten off to a sluggish start in H2. The weaker headline does not mean that Germany is on the immediate road to recession. The strength of the domestic labor market is helping to keep up private consumption, an important source of growth. Digging deeper, the construction sector remains in good shape and along with the latest PMI's and Ifo readings could be indicating that the disappointing German Q2 may not necessarily be seeping directing into Q3. The market is expecting the German economy to expand this quarter, nevertheless, the compiling of recent data would suggest that the recovery from last quarter could be muted at best.

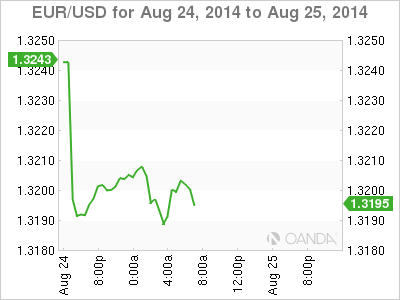

EUR only knows one direction now

This morning's weaker data has managed to push a new high in US/German spreads - 10-years at +146bp. The market has not seen these lofty levels in 15-years and there is no reason to suggest that cannot take on that years high spread of +171bp in the near term. The market continues to see decent support on pull back (139 and 141bp for starters). The EUR has managed to penetrate through the psychological € 1.32 handle to a session low of €1.3180 where there was a good demand for the 'single' unit first time around. Again, and not too much of a market surprise, barrier option are plentiful and well scattered. The first real line of supported defense in the way of option barriers can be located at € 1.3150. On the flipside, Asian and some Eurozone interest has interest to offload more EUR at and around €1.3220-30, at least on the first go around. The EUR continues to be weighed down by a Dovish Draghi and a Hawkish Yellen.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.