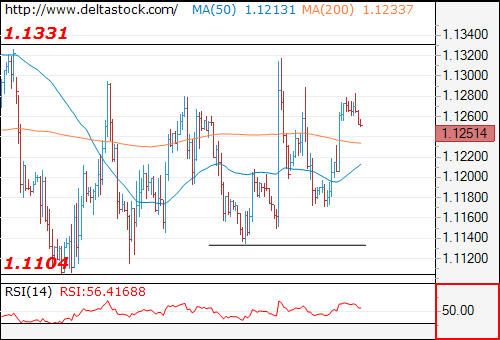

- EUR/USD

Current level - 1.1251

The recent rise from 1.1170 low leaves the bias on the lower frames neutral within the prolonged consolidation pattern above 1.1104. Key resistance on the upside is projected at 1.1330 and crucial support lies at 1.1150.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.1290 | 1.1330 | 1.1330 | 1.1460 |

| Support | 1.1150 | 1.1012 | 1.1012 | 1.0930 |

__________

- USD/JPY

Current level - 119.94

Current downswing below 120.50 should be considered corrective, preceding another leg upwards, to 121.30. Key support lies at 119.50.Current level - 119.94

| Minor | Intraday | Major | Intraweek | |

| Resistance | 120.50 | 121.32 | 122.30 | 123.70 |

| Support | 119.50 | 118.67 | 118.67 | 116.15 |

__________

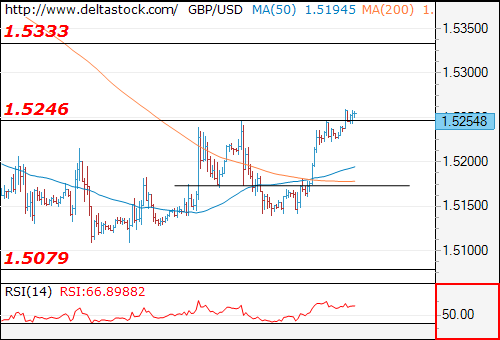

GBP/USD

Current level - 1.5254

The outlook here is positive after yesterday's climb above 1.5175, for a test of 1.5330 resistance. Initial minor support lies at 1.5217.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.5330 | 1.5330 | 1.5478 | 1.5660 |

| Support | 1.5217 | 1.5137 | 1.5080 | 1.4850 |

__________

| DATE | ORDER | ENTRY | SL | TP1 | TP2 | |

| EUR/USD | October 6 | --- | --- | --- | --- | --- |

| USD/JPY | October 5 | BUY MKT | 120.03 | 119.40 | 121.20 | --- |

| GBP/USD | October 6 | --- | --- | --- | --- | --- |

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.