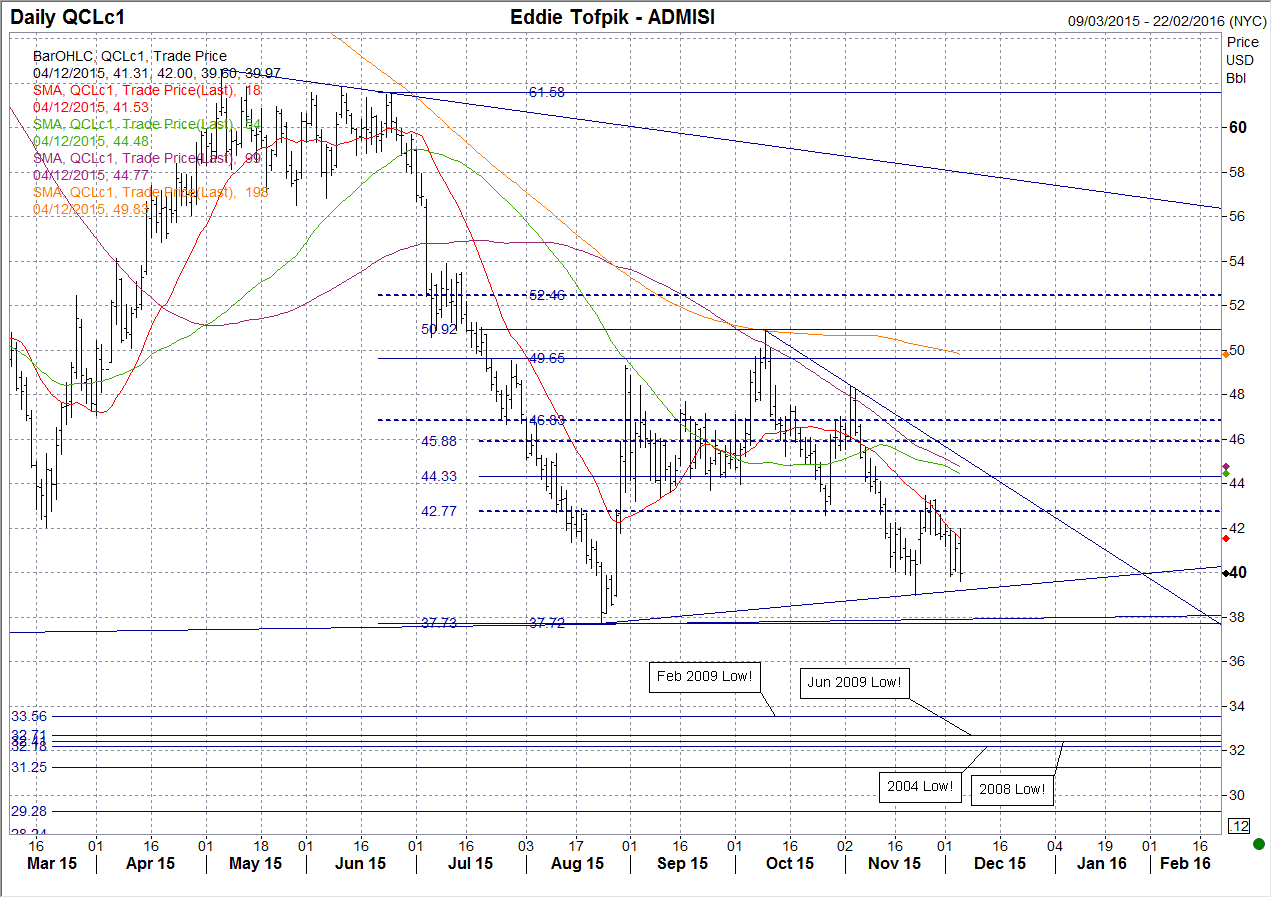

Oil - Trend Down?

I’d hope for a test of the Medium MA (currently 44.77) which the market duly supplied over the first two days of Nov and also helpfully supplied a Tweezer Top which started the move down for most of the month. The key 50% Fib at 44.33 was sliced through like butter on the way down and only a fear of round numbers saw prices fail to close the first time under 40.00! We have a Bullish Doji which relived the oversold pressure but then selling re-emerged again and we culminated with last Friday’s Key Reversal Down (…just) and closing under 40 for the first time since Aug. The pressure is there for lower prices on Monday and next week, perhaps try down to the Aug-to-date Uptrend (currently 39.23) but to honest I’m not sure it looks good. You see the whole pattern since Aug has a Descending Triangle/lopsided H+S feel to it and it would not surprise me if prices punched down to test the Aug low at 37.72. Support is there but then really nothing till 33.56 and then after that a band 32.18 – 32.71. Topside resistance is 42.00, 42.77, usually the key 50% Fib at 44.33 but I’m not sure this time but then above a dynamic band formed of the Medium MA & Oct-to-date Downtrend (currently 44.77 – 45.07) which ought to be good. All MAs point down but I’ll only push the bullet point into mildly bearish (conservative nature).

ADM Investor Services Limited – FCA No 148474 Disclaimer This information has been has been issued by ADM Investor Services International Limited (“ADMISI”) in accordance with ADMISI’s Investment Research Policy. This information is only intended to be distributed to existing Eligible Counterparties and Professional Clients of ADMISI. Further, ADMISI’s investment research is intended for use solely by Eligible Counterparties and Professional Clients, who possess a certain degree of knowledge and experience in the subject of this information. Therefore the contents may refer to terms and subjects that may be unsuitable for Retail Clients and this information should not under any circumstances be forwarded to a Retail Clients. This content is for information purposes only and should not be construed as an offer, solicitation or recommendation to buy or sell any investments or investment advice. ADMISI does not recommend or endorse any particular investment, or course of action. This information has no regard for any investment objectives or financial situation of any Eligible Counterparty or Professional Client. Any investment that is referred to may warrant further investigation or research, which will be solely at the discretion of the Eligible Counterparty or Professional Client. Information and opinions expressed herein are based on sources believed to be reliable, however ADMISI does not represent that they are accurate or complete. Further any views or information are based upon judgements made as at the date of this information. All opinions and information are subject to change without notice. ADMISI and/or connected persons may from time to time have positions in or effect transactions in any investment or related investment mentioned herein and may provide financial services to the issuers or such investments. ADMISI has put in place systems and controls mechanisms supported by appropriate procedures to identify and manage any conflicts of interest that may arise. A copy of ADMISI’s Conflict of Interest Policy is available upon request. In relation to this content, ADMISI does not believe that any relationships, circumstances, interests or potential conflicts of interest that would require disclosure under the FCA Conduct of Business rules are likely to arise. In particular no major shareholdings or financial interests exist between ADMISI and any relevant company. In the event that this situation changes then appropriate disclosures will be made. All investments involve a degree of risk and may not be suitable for certain investors. All investors should make their own investment decisions based on their circumstances, financial objectives and resources and after seeking any appropriate professional advice. This information has not been prepared under the Independent Investment research regulatory requirements and accordingly there is no prohibition on dealing ahead of the dissemination of this research material. ADM Investor Services International Limited is authorised and regulated by the Financial Conduct Authority FCA Number 148474 in the UK.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.