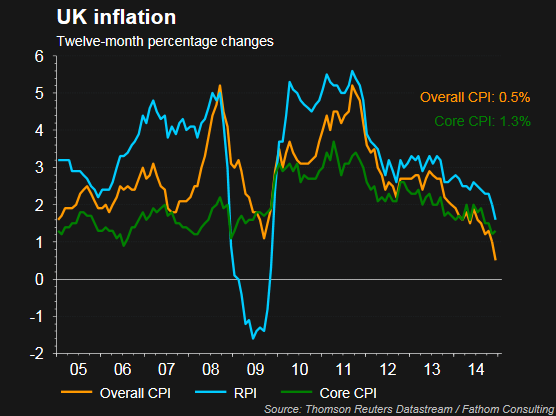

While inflation has hit low enough levels to trigger a letter from BoE governor Mark Carney to Chancellor of the Exchequer George Osborne, real wage upside remains benign, something that remains a source of concern for the BoE.

The latest UK Inflation print was the lowest since records began in 1996. The Consumer Price Index increased by 0.5 percent in the year to December 2014, down from 1.0 percent in the year to November. The CPI was previously 0.5 percent in May 2000.

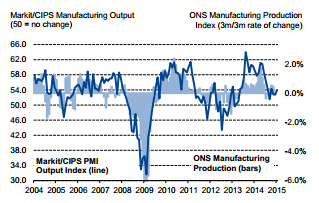

PMIs were positive, with Markit reporting that manufacturing output expanded for the twenty-third consecutive month in January, underpinned by a further increase in incoming new orders. The domestic market remained the prime driver of improved new order inflows. Solid output growth was registered at both intermediate and investment goods producers. However, the rate of growth in the consumer goods output ground to a near standstill pace.

Despite European economic concerns, there was also a modest increase in new business from overseas, representing the first meaningful improvement in new export order volumes registered for five months. Markit surveys indicated increased demand from France, Germany, Japan, the Middle East, Poland and the USA.

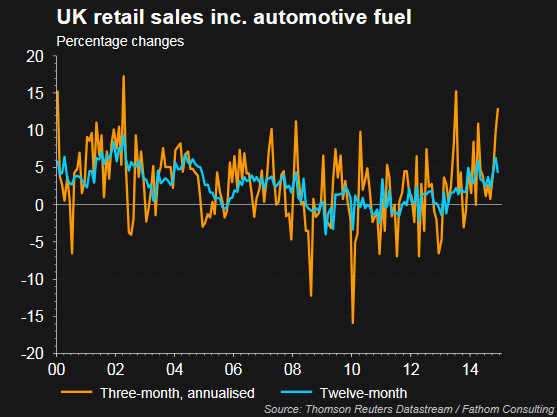

Despite the lower inflationary environment, consumer spending remains robust with December retail sales indicating 4.3 percent growth in December 2014 compared with December 2013 - the twenty-first consecutive month of year-on-year growth. Comparing the 12 months of 2014 with the 12 months of 2013 the quantity bought increased by 3.8 percent compared with 2013.

According to the most recent ONS data, the underlying pattern in the data as suggested by the three-month on three-month movement in the quantity bought continued to show growth for the 22nd consecutive month increasing by 2.3 percent and was the strongest growth since April 2002 when it was 2.5 percent. This was the longest period of sustained growth since November 2007 when there were 25 periods of consecutive growth.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.