The language of forward guidance will be the key element in tomorrow’s announcement, after the Fed’s emphasis on “considerable time” between the final tapering of its third round of quantitative easing and the first rate hike was substituted with an emphasis on “patience”, something unlikely to change in tomorrow’s statement.

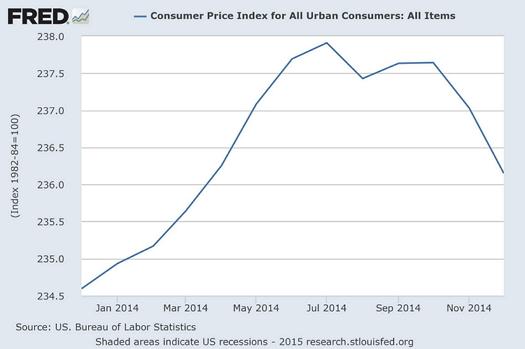

In line with the global decline in fuel prices, US CPI inflation declined to 0.8 percent in December, down from 1.3 percent in November. With lower oil prices unlikely to rebound significantly in the short-medium term, there is anticipation that inflation could fall below 0.5 percent as lower fuel prices feed into core prices.

In addition, the dollar rally forecasted through 2015 will decrease the price of US imports, further feeding into lower inflation numbers.

While the European Central Bank acted last week to unleash EUR60bn of asset purchases beginning in March, the initial effects are market rather than wider economy-based and unlikely to spur European demand for US goods and services in the short-medium term. As Mario Draghi stressed at his announcement of the ECB’s QE programme, there needs to be reform from member state governments for a return to sustained economic growth to take place.

All in all, there is unlikely to be anything in the FOMC’s statement to shake the long dollar-short euro consensus, with the Fed’s March meeting more likely to have greater market impact.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.