“After setting a historic negative and announcing additional measures, Draghi is not expected to announce anything new,†Yohay Elam suggests and other analysts participating in the forecast report agree with this opinion. “Especially, that inflation has slightly rebounded,†adds Adam Narczewski, referring to the preliminary Eurozone CPI numbers released on Monday.

The ECB Governing Council needs time to assess the impact of the June moves before deciding on further steps and this could mean that the central bank will “sit on its hands for at least the next few months,†in the opinion of Ilian Yotov. Steve Ruffley is among those who believe that the introduction of negative rates last month was a very bad move “that does nothing to support the underlying EU problem of high unemployment and limited growth prospects,†but time must pass for us to “see what effect these low rates do in a real world test.â€

Therefore, investors' attention will be focused on Mario Draghi's press conference following the interest rate announcement, during which the ECB head could “give more details about the TLTROs as well as the preparatory work related to outright purchases of asset-backed securities (ABS),†as Alberto Muñoz speculates.

“If he continues to suggest the ECB will apply the unconventional measure to boost growth, the EUR may react to the downside,†Valeria Bednarik predicts, adding that “a dovish tone, or a downgrade in the outlook, will also weight in the common currency.â€

The ECB will announce its monetary policy decision on July 3 at 11:45 GMT. Below you will find the full forecasts of the contributing market experts.

Jamie Coleman - Analyst at FXStreet:

"I expect two themes to be driven home when Draghi addresses the press on Thursday.

"I expect two themes to be driven home when Draghi addresses the press on Thursday.- 'Wait and see.' Draghi will stress that the programs announced in June have not yet been fully implemented. TLTROs won't even launch until September. ABS market rejuvenation is a long-term project and has barely begun.

- 'We have additional tools.' He won't go into much detail, frankly because there is no there there. Draghi will bluff, however, saying the governing council stands united if additional easing measures are needed.

There are outside risks that since the euro heads into the July meeting on firmer footing than it entered the June meeting, he could attempt to talk down the currency. I put the odds of that at about 1-in-3. Perhaps he will repeat that "brutal" FX moves are unwelcome, as his predecessor Trichet did in 2004 and again in 2007.

The risk for the ECB is that the market determines that it is truly out of bullets and pushes the euro even higher in an effort to provoke a policy response. Markets love to inflict pain, and that would be a very good way to do it."

Yohay Elam - Analyst at Forex Crunch:

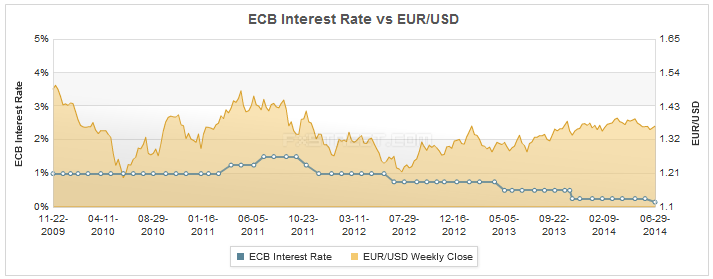

"No change is expected from the ECB. After setting a historic negative and announcing additional measures, Draghi is not expected to announce anything new. What the ECB president might do is try to talk down the value of the euro, either directly or indirectly, perhaps by opening the door to further cuts. The high value of the euro is an immediate threat to inflation and growth. Draghi has previously connected the exchange rate and monetary policy. In the last meeting, the ECB also tweaked its forward guidance, saying that rates have basically reached their lower bound. A hint about potential cuts or about a growing chance of QE could weigh on EUR/USD which trades at similar levels to those seen before the big announcement in June."

"No change is expected from the ECB. After setting a historic negative and announcing additional measures, Draghi is not expected to announce anything new. What the ECB president might do is try to talk down the value of the euro, either directly or indirectly, perhaps by opening the door to further cuts. The high value of the euro is an immediate threat to inflation and growth. Draghi has previously connected the exchange rate and monetary policy. In the last meeting, the ECB also tweaked its forward guidance, saying that rates have basically reached their lower bound. A hint about potential cuts or about a growing chance of QE could weigh on EUR/USD which trades at similar levels to those seen before the big announcement in June."Steve Ruffley - Chief Market Strategist at InterTrader.com:

"The ECB it seems are full of surprises, or indeed not so as the introduction of negative rates was pretty much as the market expected. I have been very outspoken about how much of a bad idea this is and still maintain that if low rates were the way to fix the economy then this would have work by now. I expect nothing much from Draghi in this meeting, he has played his had so it is now a wait and see period.

"The ECB it seems are full of surprises, or indeed not so as the introduction of negative rates was pretty much as the market expected. I have been very outspoken about how much of a bad idea this is and still maintain that if low rates were the way to fix the economy then this would have work by now. I expect nothing much from Draghi in this meeting, he has played his had so it is now a wait and see period. The cheap lending does not seem to be aimed at generating business by growth or job creation but once again to make sure people can sustain their increasing debt burden. The inflation figures are still in focus so we will have to see what effect these low rates do in a real world test. I just see this is an yet another Draghi sticking plaster that does nothing to support the underlying EU problem of high unemployment and limited growth prospects."

Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

"Having in mind the last ECB meeting, this time nothing interesting should happen. Especially, that inflation has slightly rebounded. Sure, on the press conference I expect to hear that in case of worse economic conditions the bank still has options that can be introduced, but this time the statement can be more general. That means that the situation on the EUR/USD should not change leaving it still some upside potential."

"Having in mind the last ECB meeting, this time nothing interesting should happen. Especially, that inflation has slightly rebounded. Sure, on the press conference I expect to hear that in case of worse economic conditions the bank still has options that can be introduced, but this time the statement can be more general. That means that the situation on the EUR/USD should not change leaving it still some upside potential."Ilian Yotov - FX Strategist and Founder at AllThingsForex:

"After the ECB announced the rate cuts and easing measures last month, chances are very low that policy makers will get even more aggressive at the July meeting. This is why we expect the ECB to sit on its hands for at least the next few months. However, the ECB will probably continue to remind the market of its willingness to keep the door open to more easing, which should keep any EUR gains capped."

"After the ECB announced the rate cuts and easing measures last month, chances are very low that policy makers will get even more aggressive at the July meeting. This is why we expect the ECB to sit on its hands for at least the next few months. However, the ECB will probably continue to remind the market of its willingness to keep the door open to more easing, which should keep any EUR gains capped." Clemente De Lucia - Economist at BNP Paribas:

"Unwanted tightening of the policy stance, further impairments in the transmission of the monetary policy stance and a worsening of the medium-term outlook for inflation are factors which might trigger a reaction from the ECB according to its forward guidance. A combination of these factors is affecting the eurozone and against this backdrop the ECB launched package of measures in June which aims at easing further the ECB monetary policy stance, enhance the transmission of its stance, and eventually boosting growth and lifting inflation and inflation expectations.

"Unwanted tightening of the policy stance, further impairments in the transmission of the monetary policy stance and a worsening of the medium-term outlook for inflation are factors which might trigger a reaction from the ECB according to its forward guidance. A combination of these factors is affecting the eurozone and against this backdrop the ECB launched package of measures in June which aims at easing further the ECB monetary policy stance, enhance the transmission of its stance, and eventually boosting growth and lifting inflation and inflation expectations.While those measures have already produced positive effects in terms of lowering interest rates both at shorter and longer maturities and cause a slightly depreciation of the euro, it is too early to gauge the full impact on the economy. According to President Draghi several quarters are indeed needed. This means that the ECB will not embark on further actions for a while. Therefore we do not expect any major change at this week Governing Council meeting. Yet, the ECB will probably continue to stress that it could do more if things go wrong."

Alistair Cotton - Senior Analyst at Currencies Direct:

"We expect no changes from the ECB at this month’s meeting after Mario Draghi unholstered the bazooka last month. A period of calm is needed to let the dust settle. What the market is expecting is further details on potential QE, when it might occur and the sort of quantity the ECB is considering. As the euro has regained a good deal of the drop off it suffered in the immediate aftermath of the announcement, Mario Draghi might take the opportunity to weaken the euro again possibly by suggesting QE will be here faster than the market currently thinks."

"We expect no changes from the ECB at this month’s meeting after Mario Draghi unholstered the bazooka last month. A period of calm is needed to let the dust settle. What the market is expecting is further details on potential QE, when it might occur and the sort of quantity the ECB is considering. As the euro has regained a good deal of the drop off it suffered in the immediate aftermath of the announcement, Mario Draghi might take the opportunity to weaken the euro again possibly by suggesting QE will be here faster than the market currently thinks."Bill Hubard - Chief Economist at Markets.com:

"Regarding next week’s ECB meeting, we might see one of the shortest press conferences in ECB history. It should be the calm after the storm. The ECB will now take some months to assess the impact of its June measures before even considering further steps.

"Regarding next week’s ECB meeting, we might see one of the shortest press conferences in ECB history. It should be the calm after the storm. The ECB will now take some months to assess the impact of its June measures before even considering further steps.Thursday evening, an ‘ECB source’ story published by MNS made the rounds, suggesting that the ECB may consider cutting the deposit rate to -25 bps, underlining that any agreement on QE may be difficult. The unnamed source reportedly also stressed that the ECB has to assess the impact of the last round of easing measures before considering further action. This is in line with official comments since the last meeting, and ‘suggests’ that the ECB will be ‘on hold’ for at least SIX months, as the TLTROs will not start immediately and will take time to have an effect."

Nicky Ong - Co-Founder of Traders Corner:

"Last month the ECB introduced a host of policy measures aimed at stimulating the Euro zone economy. Such measures included negative interest rates and cheap long term loans to banks.

"Last month the ECB introduced a host of policy measures aimed at stimulating the Euro zone economy. Such measures included negative interest rates and cheap long term loans to banks.Recent data suggests the ECB’s monetary policy decisions are justified as weakness in the core of the Eurozone was reflected in another disappointing consumer spending release in Germany.

This time around I expect most of the headlines to come from the post announcement press conference where Mario Draghi will no doubt be questioned intensively.

Dovish comments from ECB Executive Board Member Yves Mersch over the weekend suggests Mario Draghi will use this opportunity to reaffirm the ECB’s willingness to protect the Eurozone’s fragile recovery and combat disinflation, but stop short of any additional measures at this point."

Ahmed Mamdouh – Analyst at ICN.com:

"The ECB is unlikely to announce further cut in interest rates this month as it has reached the minimum and more cuts may not be effective. ECB President Mario Draghi will probably give an update about the new measures announced in June by divulging more details, especially on the targeted long-term refinancing operations and the conditions banks must live up to take part in it."

"The ECB is unlikely to announce further cut in interest rates this month as it has reached the minimum and more cuts may not be effective. ECB President Mario Draghi will probably give an update about the new measures announced in June by divulging more details, especially on the targeted long-term refinancing operations and the conditions banks must live up to take part in it."Alberto Muñoz, Ph.D. - Forex Analyst at FXStreet:

"I would not expect important news in the next ECB meeting. Probably Draghi will dedicate some time to provide more details about the current monetary policy measures as well as give some clues about what's next. In particular, Draghi will give more details about the TLTROs as well as the preparatory work related to outright purchases of asset-backed securities (ABS). Also we could have a surprise if Draghi decides to speak about a possible QE programme although I think that the ECB Governing Council is more focused on the recent measures and it's not going to introduce new changes as long as inflation remains low but steady. In conclusion, I think this meeting will be a mere formality that will probably add some momentary volatility to EURUSD but expect the pair to remain unchanged at the end of the day (if NFP wasn't released, of course)."

"I would not expect important news in the next ECB meeting. Probably Draghi will dedicate some time to provide more details about the current monetary policy measures as well as give some clues about what's next. In particular, Draghi will give more details about the TLTROs as well as the preparatory work related to outright purchases of asset-backed securities (ABS). Also we could have a surprise if Draghi decides to speak about a possible QE programme although I think that the ECB Governing Council is more focused on the recent measures and it's not going to introduce new changes as long as inflation remains low but steady. In conclusion, I think this meeting will be a mere formality that will probably add some momentary volatility to EURUSD but expect the pair to remain unchanged at the end of the day (if NFP wasn't released, of course)."Valeria Bednarik - Chief Analyst with FXStreet:

"Market expectations for upcoming ECB meeting are limited after the Central Bank cut its benchmark rate to record lows and introduced negative deposits rates. Attention will focus then on what Draghi has to say on the QE matter. If he continues to suggest the ECB will apply the unconventional measure to boost growth, the EUR may react to the downside, as market players will focus on the widening imbalance between economic policies compared to other countries. A dovish tone, or a downgrade in the outlook, will also weight in the common currency."

"Market expectations for upcoming ECB meeting are limited after the Central Bank cut its benchmark rate to record lows and introduced negative deposits rates. Attention will focus then on what Draghi has to say on the QE matter. If he continues to suggest the ECB will apply the unconventional measure to boost growth, the EUR may react to the downside, as market players will focus on the widening imbalance between economic policies compared to other countries. A dovish tone, or a downgrade in the outlook, will also weight in the common currency."

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.