As the ECB has already signaled that no more interest rate cuts are on the table, attention turns to the central bank's efforts to expand its balance sheet. In the opinion of Ilian Yotov, “not only is the ECB one step closer to launching a full-blown QE program, but the divergence in the monetary policies between the ECB and the Fed is now more than obvious.” Therefore, as Clemente de Lucia suggests, “the ECB might decide to step up its rhetoric, hinting that it has still several available options were the current security purchase programs and lending scheme not provoking the desired effects for lifting inflation and strengthening the recovery.” Such a comment would considerably weigh on the euro.

Adam Narczewski on the other hand sees Mario Draghi confirming the initiation of previously introduced programs, while Valeria Bednarik adds that “the ECB is expected to keep on working on its ABS program, expected to be launched this November, but bring nothing new to the table.” In that case Alberto Muñoz projects EUR/USD trading close to 1.2500 following the ECB meeting, although he suggests that “we should see a weak Euro in the forthcoming weeks, drifting lower to test the key support area between 1.2050 and 1.2120.”

Meanwhile, the BoE should remain on the sidelines, with no changes to the monetary policy or even hints about possible adjustments expected this month. “The real show is at the release of the meeting minutes on November 19th,” suggests Yohay Elam. “While some see a rate hike being pushed back all the way to the end of 2015, wage growth could pick up and the BoE would like to be ahead of the curve, eventually raising rates in March or April.”

The BoE and the ECB will announce their monetary policy decisions on November 6 at 12:00 and 12:45 GMT, respectively. Below you will find the full forecasts of the contributing market experts.

Clemente De Lucia - Economist at BNP Paribas:

ECB:

ECB:"No major changes are expected from the November ECB Governing Council meeting. The Bank should stress again its willingness to do more if the measures adopted so far do not produce the expected results. Admittedly, over past weeks there were rumors that the ECB might enlarge the list of private sector securities eligible to purchase, including corporate bonds. Despite being a valid option, we doubt the ECB will proceed on this line soon, at least not before having assessed the impact on the economy of the measures adopted so far. The ECB has just started its third Covered Bond program and it will start buying ABS during the quarter. In addition in December, throughout next year and up to mid-2016, it will conduct the other seven Targeted Longer Term Refinancing Operations (TLTROs). Yet, the ECB might decide to step up its rhetoric, hinting that it has still several available options were the current security purchase programs and lending scheme not provoking the desired effects for lifting inflation and strengthening the recovery."

Yohay Elam - Analyst at Forex Crunch:

ECB:

ECB:"No changes are expected in rates, as the ECB stated they have "reached their lower bound". The main lending rate stands at +0.05% and the deposit rate at -0.20%. The big question is: how far is the ECB willing to go in order to expand its balance sheet? ABS is probably not enough. Buying corporate bonds has been floated, and outright QE, buying sovereign bonds is a delicate issue for German policymakers. While Japan added QE, this may not be enough to counter the end of the same program in the US. Will Draghi drop a hint of a wider, faster expansion of the balance sheet? If so, it could significantly hurt the euro, but he is more likely to refrain for this for now, given his known discord with Bundesbank president Jens Weidmann."

BoE:

"The BOE is expected to leave the rates unchanged once again. Earlier in the year, November was seen as a potential time to raise rates. However, weak inflation, currently at 1.2%, means the BOE is likely to leave it for the spring, as Carney noted in a recent testimony. The real show is at the release of the meeting minutes on November 19th. While some see a rate hike being pushed back all the way to the end of 2015, wage growth could pick up and the BOE would like to be ahead of the curve, eventually raising rates in March or April."

Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

ECB:

ECB: "As for the next ECB meeting, I hear around that the bank might soften the limits of TLTRO program or could speed up the process of ABS buyback. Sure, those can be announced but I give it low probability. Rather, Mari Draghi will just confirm the ECB will start executing the announced programs. If the macro environment keeps deteriorating, then I would expect Mario to intervene. At this moment, I do not see the ECB adding more to the easing programs they have announced recently."

BoE:

"The BoE is (along with the Fed) one of the major central banks that could be increasing interest rates soon. Soon, means next year at the earliest to me. Still, we will all be awaiting any signals of the timing of those hikes but on the upcoming meeting I do not expect those. It should not be a revolutionary meeting and the MPC members should vote 7-2 for keeping interest rates at the current level."

Ilian Yotov - Portfolio Manager at ATFX Currency Management:

ECB:

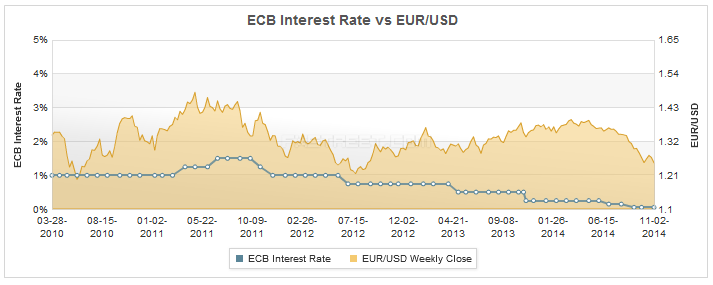

ECB:"With the Fed ending its QE program, while the euro-zone economy is stagnating and inflation is nowhere near the 2% target, the odds of even more easing by the European Central Bank are very high. The ECB President Draghi has been very clear about the ambitious plans to expand the ECB balance sheet and of the central bank's openness to use additional unconventional measures to ease policy further. Not only is the ECB one step closer to launching a full-blown QE program, but the divergence in the monetary policies between the ECB and the Fed is now more than obvious, which should keep the EUR under pressure."

BoE:

"The threat of a recession in the euro-zone, the United Kingdom's largest trading partner, is a concern for the Bank of England policy makers and will probably prolong the timing of the bank's first rate hike. Two MPC members have voted to raise rates in recent months, but if they begin to change their view, that should be a good sign that rate hike expectations will be pushed farther down the time line- a factor that should weigh on the GBP."

Ahmad Mamdouh - Analyst at ICN.com:

ECB:

ECB:"The European Central Bank is set to hold off its stimulus bazooka this month to come back again to the “wait and see” approach until the programs announced over the few couple of months, including the new ABS purchases starting this month, begin to show their efficacy.

It is reasonable to claim that the rise in October’s inflation to 0.4 percent is likely to prompt policymakers to hold their fire this week. Most probably, the bank will remain without any new actions until the beginning of the 2015, where further cuts in interest rates seem to be fortuitous."

Mohamed Galal - Analyst at ICN.com:

BoE:

BoE:"The Bank of England will probably keep its monetary stance on hold this month as the weakness in the euro area economy still poses a threat to U.K. recovery despite the recent economic progress represented in the strong growth pace and drop in unemployment.

Policymakers at the BOE are likely to refrain from tightening their monetary policy in the near term in order not to diverge from the ECB’s bold monetary easing.

More insights about the bank’s intended monetary steps will be illustrated in the BOE quarterly inflation report due later in the month, noting that inflation, currently at 1.2 percent, is still far from the BOE’s target of 2 percent and the wage growth is still weak."

Jameel Ahmad, Chief Market Analyst, at Forex Time:

ECB: "The EU economic sentiment continued to bleaken further last month, with fears over Germany entering a recession continuing to gather momentum. We are entering a crucial month of economic data for the Eurozone where clarity in regards to issues such as stagnant economic growth and fears of a German recession will be answered. The latter proving correct would obviously have bearish implications for the Euro with Germany the largest economy in the EU. However, although the Eurozone economic concerns are very serious, there might yet be some light at the end of the tunnel. For example, recent PMIs and inflation data has come in above expectations and this will at least increase optimism that a weaker exchange rate will help economic fortunes.

"The EU economic sentiment continued to bleaken further last month, with fears over Germany entering a recession continuing to gather momentum. We are entering a crucial month of economic data for the Eurozone where clarity in regards to issues such as stagnant economic growth and fears of a German recession will be answered. The latter proving correct would obviously have bearish implications for the Euro with Germany the largest economy in the EU. However, although the Eurozone economic concerns are very serious, there might yet be some light at the end of the tunnel. For example, recent PMIs and inflation data has come in above expectations and this will at least increase optimism that a weaker exchange rate will help economic fortunes. In regards to the ECB decision, I am not expecting any changes in monetary policy this month. The topic of Quantitative Easing fails to go away, but it will just be so difficult to implement. QE involves purchasing government bonds and I do not think the markets are realizing quite how difficult it would be for the ECB to introduce QE. I mean, how do you differentiate between so many different government bonds? Each bond would have a completely different risk rating for example.

Overall, I would expect more comments from Mario Draghi to highlight that the EU recovery remains “weak, fragile and uneven”. Draghi might even attempt to send the Euro lower by highlighting that Germany entering a recession would put the whole Eurozone at risk. Nonetheless, traders should be weary that this week includes a great deal of high risk US economic data. Demand for the Dollar is strong following the Fed’s conclusion to QE and better than expected US GDP. However, there is always a risk of investors closing their positions and taking profit on the USD. We saw that a few weeks ago, and we shouldn’t necessarily assume the Eurodollar will continue drifting below 1.25 either."

BoE:

"It already seems a foregone conclusion that the BoE will be leaving monetary policy unchanged in November. For this reason, the reaction to the interest rate decision might be muted on the currency markets.

The recent BoE minutes release certainly provided a clear indication that the Monetary Policy Committee (MPC) remain quite some distance away from even having a third member joining the dissenter’s table, let alone raising interest rates. The downside risk to the Cable’s valuation is that the tone from the BoE right now is probably even more dovish than one month ago. For example, comments investors reacted unfavorably to during the recent BoE Minutes release included concern among the MPC regarding weak price pressures (inflation) and EU economic problems possibly having a detrimental impact on the UK economy. There was even a reiteration from the MPC that UK economic momentum would continue to slow down during the latter period of 2014. Since the last BoE meeting, inflation has unexpectedly fallen to 1.2% and UK economic growth slowed to an annualised 3% in Q3, compared to an annualised 3.2% in Q2 – providing valid reasons for the BoE to leave monetary policy unchanged for longer.

Despite some noticeable reasons for the MPC dissenters (currently two) to consider switching votes back to being against an interest rate increase – it appears that at least Ian McCafferty will remain as a dissenter this Thursday. Although UK economic momentum might have slowed down, an annualised GDP figure at 3% is still impressive and, just recently, the IMF declared the UK economy to be the fastest growing economy in the advanced world. In truth, the UK’s fundamentals continue to look strong – you just have to look at Monday’s Manufacturing PMI, where the manufacturing sector unexpectedly expanded at its fastest pace in three months, to be reminded of that. As long as the fundamentals continue to impress, fears regarding the UK economy suffering from the EU’s woes will be limited. Not only this, but more improved PMIs over the coming weeks will have a positive impact on the currently weak UK inflation levels.

Overall, the last time the BoE provided an indication to expect a UK rate rise was around the Scottish referendum in September. Back then, the BoE suggested a rate hike could be expected around Spring 2015 and I still think this is an achievable timeframe."

Alistair Cotton - Senior Analyst at Currencies Direct:

"We expect no policy changes from the Bank of England or ECB this week. Instead the focus will remain on the details of the ECB asset purchase plan which markets hope Mario Draghi will reveal in more detail at his press conference on Thursday. The lack of support coming from Germany about outright QE is the main worry – Mario Draghi originally reversed the funding crisis in sovereign bond markets by stating the ECB will do ‘whatever it takes’ to support the euro. Markets are strange places where future expectations of market participants can influence outcomes in the present, and the current lack of explicit support by Germany for the ECB plan is a great example. The ECB bond buying program will be less effective without this, even if operationally it is the same.

"We expect no policy changes from the Bank of England or ECB this week. Instead the focus will remain on the details of the ECB asset purchase plan which markets hope Mario Draghi will reveal in more detail at his press conference on Thursday. The lack of support coming from Germany about outright QE is the main worry – Mario Draghi originally reversed the funding crisis in sovereign bond markets by stating the ECB will do ‘whatever it takes’ to support the euro. Markets are strange places where future expectations of market participants can influence outcomes in the present, and the current lack of explicit support by Germany for the ECB plan is a great example. The ECB bond buying program will be less effective without this, even if operationally it is the same. There are also concerns about the timing of bond purchases. The ECB has been buying covered bonds already, but the ABS program is set to start only in December. The move last week by the Bank of Japan to markedly asset purchases has increased pressure on the ECB to follow suit, especially given the impact of the policy in FX space, which drove the Yen through multiyear lows against the euro. The move by the BoJ shows catching the market by surprise gives maximum impact. Mario Draghi should take note."

Alberto Muñoz, Ph.D. - Forex Analyst at FXstreet.com:

ECB:

ECB:"November's ECB meeting will be probably quiet. On one hand, the ECB will not announce new measures (forget about the QE for several months, it's just not politically practicable) and on the other hand, it's too early for the ECB to judge the impact of the new programmes as they have started just a couple of weeks ago. Also many members of the Governing Council have suggested that interest rates have reached the lower bound and that the ECB has done all it can on monetary policy so I would not expect too much volatility, probably the EURUSD will oscillate around 1.2500, though we should see a weak Euro in the forthcoming weeks, drifting lower to test the key support area between 1.2050 and 1.2120."

BoE:

"I wouldn't expect any surprise here: while UK economy continues its steady recovery, wages remain weak which could be signaling some slack in the economy and of course it could have an important impact in inflation. Therefore expect another "wait-and-see" meeting where the BoE will do nothing. GBPUSD will probably dive some pips after the release but don't expect a big follow-through, as long as the pair remains trading in the 1.5930 - 1.6030 range."

Valeria Bednarik - Chief Analyst with FXStreet:

ECB:

ECB:"With EZ inflation at 0.4% monthly basis, but YoY one at 0.7%, the ECB has no room to maneuver towards a more hawkish stance, something than anyway the bank does not want: they need a weaker EUR to boost the economy. If Mario Draghi announces further easing against the odds, the imbalance between Central Banks will only widen, and after the unpredictable initial reaction, the EUR will likely resume its slide towards fresh lows. Nevertheless, the ECB is expected to keep on working on its ABS program, expected to be launch this November, but bring nothing new to the table."

BoE:

"Once again, I'm not expecting anything from BOE meeting, and believe market attention will turn towards Minutes, 2 weeks later, where no changes are either expected. The Bank of England will probably maintain a steady stance well into the first half of 2015."

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.