"It is hard to predict what the Central Bank may choose to do," says Valeria Bednarik, adding that apart from the euro strength "there are no big changes in the main factors in which authorities base their decision." Eurozone inflation remained low and growth subdued.

"In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers," Yohay Elam points out.

Various ECB Governing Council Members have spoken over the past few weeks, acknowledging the risk of deflation in the Eurozone and signaling that they were ready to take action against the trend. Most recently, Slovakia's central bank Governor Josef Makuch said that "nonstandard measures to prevent slipping into a deflationary environment" were discussed, although he didn't want to give any further details.

Even Buba head Jens Weidman suggested recently that a bond purchase program, similar to the US Fed's quantitative easing, could be adopted, despite the fact that Germany was until now the biggest opponent of such a solution.

Ilian Yotov, who believes that we won't see a rate cut at ECB's upcoming meeting, adds however that "the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode." Phil McHugh on the other hand sees a possibility that the first move could be made already in April and it could involve the introduction of a negative deposit rate or a stimulus program. Adam Narczewski also takes a negative deposit rate into consideration, but also a "slight cut of the main refinancing rate (by less than 25bp)" and gives the action scenario a 50/50 chance.

The ECB will announce its monetary policy decision on April 3 at 11:45 GMT. Below you will find the full forecasts of the contributing economists.

Ilian Yotov - FX Strategist and Founder at AllThingsForex:

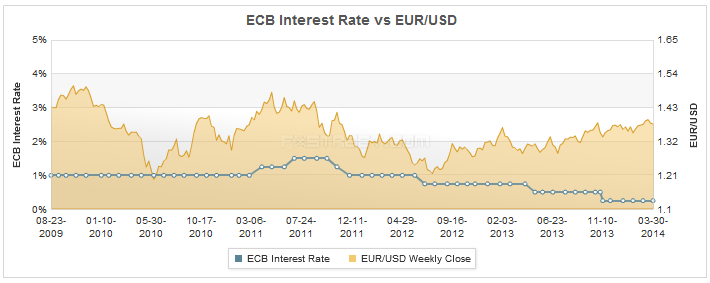

"Once again, the European Central Bank will be likely to disappoint the euro bears by not cutting rates in April. However, the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode, which could weigh on the euro, especially if the Fed does not backpaddle and maintains its hawkish stance while the U.S. economic data improves from the weakness seen in the winter months. The EUR/USD exchange rate will probably stay in the $1.33-$1.40 range until the Fed gets closer to ending the QE program in late October, 2014."

"Once again, the European Central Bank will be likely to disappoint the euro bears by not cutting rates in April. However, the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode, which could weigh on the euro, especially if the Fed does not backpaddle and maintains its hawkish stance while the U.S. economic data improves from the weakness seen in the winter months. The EUR/USD exchange rate will probably stay in the $1.33-$1.40 range until the Fed gets closer to ending the QE program in late October, 2014."Yohay Elam - Analyst at Forex Crunch:

"Assuming that both CPI and Core CPI do not fall below 0.5% in the flash reading for March, the ECB is likely to refrain from new stimulus. Draghi showed us that the bar is high for more stimulus in the previous meeting. In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers. A lack of action in policy does not meet a lack of market action: Draghi may certainly raise the so far subtle rhetoric regarding the exchange rate. The high value of the euro weighs on exports and pushes inflation lower due to cheaper imports. It seems like 1.40 is the "line in the sand" and it will not come as a surprise if Draghi plays down the euro. However, verbal intervention is usually short lived, and action will probably be needed later on in the year."

"Assuming that both CPI and Core CPI do not fall below 0.5% in the flash reading for March, the ECB is likely to refrain from new stimulus. Draghi showed us that the bar is high for more stimulus in the previous meeting. In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers. A lack of action in policy does not meet a lack of market action: Draghi may certainly raise the so far subtle rhetoric regarding the exchange rate. The high value of the euro weighs on exports and pushes inflation lower due to cheaper imports. It seems like 1.40 is the "line in the sand" and it will not come as a surprise if Draghi plays down the euro. However, verbal intervention is usually short lived, and action will probably be needed later on in the year."Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

"Some big investment banks have been forecasting that in April the ECB will cut interest rates. Additionally, ECB'S Makuch stepped in to say that they are getting ready for such scenario and that the euro is too strong. On the other hand, since the last monetary policy meeting, macro data has not shown any deterioration. If the ECB acts, it could introduce a negative deposit rate (-0,1%?) or a slight cut of the main refinancing rate (by less than 25bo?). I predict the chances for such a scenario are 50/50. Lets remember though the ECB likes to surprise the markets (as Mario Draghi has proven many times)At the last ECB meeting, action was expected and nothing happened. So this time we have to be ready for everything, like before any ECB's statements."

"Some big investment banks have been forecasting that in April the ECB will cut interest rates. Additionally, ECB'S Makuch stepped in to say that they are getting ready for such scenario and that the euro is too strong. On the other hand, since the last monetary policy meeting, macro data has not shown any deterioration. If the ECB acts, it could introduce a negative deposit rate (-0,1%?) or a slight cut of the main refinancing rate (by less than 25bo?). I predict the chances for such a scenario are 50/50. Lets remember though the ECB likes to surprise the markets (as Mario Draghi has proven many times)At the last ECB meeting, action was expected and nothing happened. So this time we have to be ready for everything, like before any ECB's statements."Phil McHugh - Senior Analyst at Currencies Direct:

"The ECB seems to be gearing for some activity in the near future. Recent comments from Bundesbank president Jens Weidmann indicate that Quantitative Easing is not out of the question. In addition, negative interest rates discussions have also been revisited by ECB officials. Although Mario Draghi is still keeping his cards close to his chest, a strong euro and the risk of deflation is likely to spark some activity, possibly as early as the April meeting."

"The ECB seems to be gearing for some activity in the near future. Recent comments from Bundesbank president Jens Weidmann indicate that Quantitative Easing is not out of the question. In addition, negative interest rates discussions have also been revisited by ECB officials. Although Mario Draghi is still keeping his cards close to his chest, a strong euro and the risk of deflation is likely to spark some activity, possibly as early as the April meeting."Steve Ruffley - Chief Market Strategist at InterTrader.com:

"With the Euro at a 2 ½ high against the Dollar, there are increasing pressures on European consumers and for the ECB to address this. The unfortunate situation is that with the aim to still stimulate growth there is very little room for manoeuvre on rates. Saying this the only reason we have seen any growth is by consumers taking advantage of cheap money. Maybe the ECB should just bite the bullet and realise that we have done all we can with low rates and use other more aggressive stimulus policies to kick start the economy.

"With the Euro at a 2 ½ high against the Dollar, there are increasing pressures on European consumers and for the ECB to address this. The unfortunate situation is that with the aim to still stimulate growth there is very little room for manoeuvre on rates. Saying this the only reason we have seen any growth is by consumers taking advantage of cheap money. Maybe the ECB should just bite the bullet and realise that we have done all we can with low rates and use other more aggressive stimulus policies to kick start the economy. With companies in the UK, Europe and US holding some the largest cash reserves in history, maybe it is time for the world’s governments to impose windfall type taxes? My ideas would be that you have to give 2% of cash reserves or profits directly to employees as bonuses. Why not try and stimulate the economy that way, get people spending company money not borrowing more!"

Bill Hubard - Chief Economist at Markets.com:

"Should forward-looking indicators start to disappoint, this could weigh on EUR given a relatively upbeat growth outlook has been one of the key factors keeping the central bank on hold. Indeed, credit and inflation have both been a concern for the ECB, and we expect lending data (Thur) to be weak. With the euro area CPI revised down last week, the market may focus on the release of the ‘flash’ estimate of German CPI on Friday. We expect an unchanged print. Further weakness in inflation could cause the market to speculate on action from the ECB."

"Should forward-looking indicators start to disappoint, this could weigh on EUR given a relatively upbeat growth outlook has been one of the key factors keeping the central bank on hold. Indeed, credit and inflation have both been a concern for the ECB, and we expect lending data (Thur) to be weak. With the euro area CPI revised down last week, the market may focus on the release of the ‘flash’ estimate of German CPI on Friday. We expect an unchanged print. Further weakness in inflation could cause the market to speculate on action from the ECB."Ahmad Mamdouh - Analyst at ICN.com:

"ECB President Mario Draghi slashed the benchmark interest rate to record low of 0.25 percent in November last year when inflation hit the current level of 0.7 percent. Therefore, the ECB will probably introduce new stimulus in April after the recent drop in inflation has sparked concerns of a deflationary cycle.

"ECB President Mario Draghi slashed the benchmark interest rate to record low of 0.25 percent in November last year when inflation hit the current level of 0.7 percent. Therefore, the ECB will probably introduce new stimulus in April after the recent drop in inflation has sparked concerns of a deflationary cycle.Although growth is showing a gradual improvement, a long-period of low inflation may hamper the recovery trajectory and hence a new bank-lending programs and large-scale asset purchases may be on the table."

Valeria Bednarik - Chief Analyst at FXStreet:

"I believe this time, is hard to predict what the Central Bank may choose to do. Compared to last month, there are no big changes in the main factors in which authorities base their decision, except maybe Euro strength: inflation remains low, growth subdue, and overall Draghi words have tend to be hawkish during this last month. As per now, ECB officers had been started to down talk the currency, but the fact is that without action to back up the wording, the EUR will continue attracting buyers. If the Central Bank stays on hold, the most likely scenario is further EUR gains, looking for fresh year highs against the greenback."

"I believe this time, is hard to predict what the Central Bank may choose to do. Compared to last month, there are no big changes in the main factors in which authorities base their decision, except maybe Euro strength: inflation remains low, growth subdue, and overall Draghi words have tend to be hawkish during this last month. As per now, ECB officers had been started to down talk the currency, but the fact is that without action to back up the wording, the EUR will continue attracting buyers. If the Central Bank stays on hold, the most likely scenario is further EUR gains, looking for fresh year highs against the greenback."Alberto Muñoz, Ph.D. - Forex Analyst at FXStreet:

"It looks clear that the ECB is worried about the Euro rate exchange against many currencies; also the latest Eurozone inflation data suggest that prices might be slowing down so it's very likely that Draghi will insist in that the ECB is ready to take additional measures if needed, trying to jawbone the market to lower the Euro. In my opinion, regardless what he could say, the market will consider that the Euro is bearish even if there are no new measures so expect a break below 1.3750 which is a key EURUSD support level."

"It looks clear that the ECB is worried about the Euro rate exchange against many currencies; also the latest Eurozone inflation data suggest that prices might be slowing down so it's very likely that Draghi will insist in that the ECB is ready to take additional measures if needed, trying to jawbone the market to lower the Euro. In my opinion, regardless what he could say, the market will consider that the Euro is bearish even if there are no new measures so expect a break below 1.3750 which is a key EURUSD support level."

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.