The release of retail sales in March was the last important set of data ahead of the first estimate for GDP growth in Q1 due out next week.

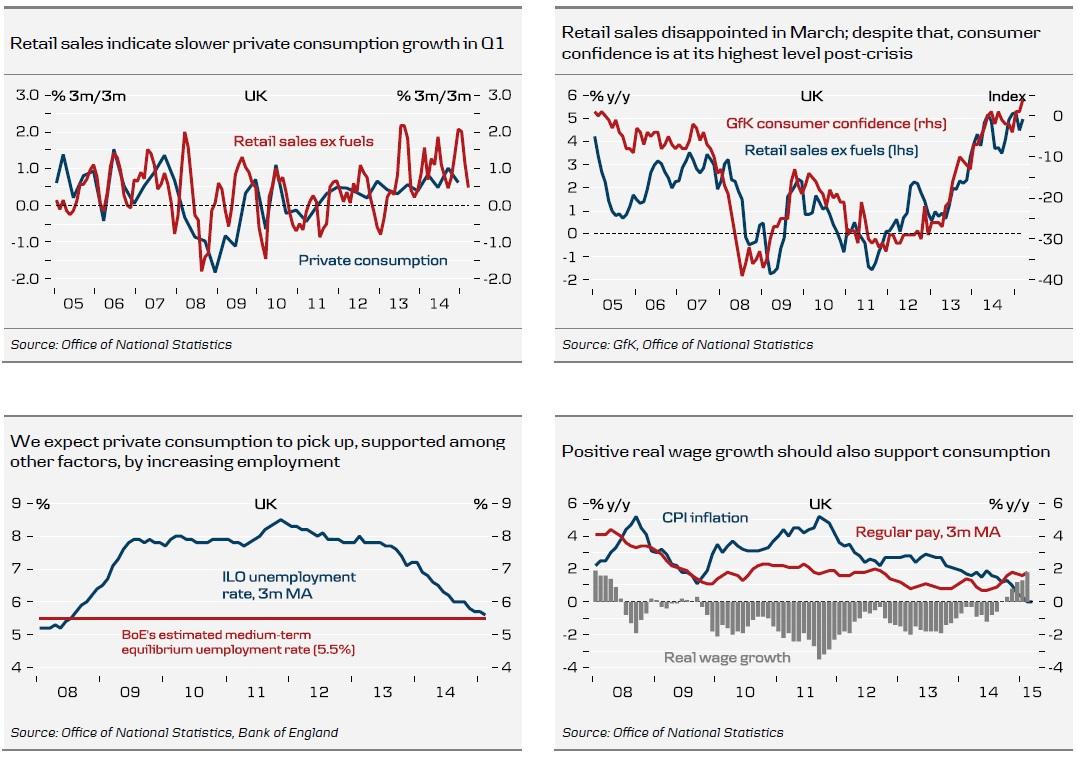

Retail sales declined by 0.5% m/m in March. Excluding auto fuel, they rose by 0.2% m/m. This was below what analysts had expected (Reuters survey). We had anticipated a large increase in retail sales in March as they were weak in both January and February. Total retail sales grew 0.9% q/q in Q1 while excluding auto fuel they increased by 0.5% q/q. Overall, retail sales disappointed despite high consumer confidence, increasing employment and positive real wage growth for the first time since 2009.

Retail sales are volatile, but they indicate that growth in private consumption and hence also output in services slowed in Q1. They also indicate that private consumption and output in services both grew around 0.5% q/q. If so, output in services (78.4% of GDP) may have contributed as little as 0.4pp to GDP growth in Q1, down from 0.7pp in Q4 14.

Since not only retail sales but also production and construction figures disappointed in Q1 (despite strong survey indicators) GDP growth seems to have slowed in Q1. Our calculations suggest that production did not contribute to growth in Q1 while construction output pulled growth down.

Overall, hard data in Q1 indicate that GDP growth may have slowed to as low as 0.25% q/q compared to 0.6% q/q in Q4 14.

Despite the slowdown in growth in Q1, we expect it to rebound in the coming quarters. Higher employment and positive real wage growth should support private consumption. The economic recovery in the rest of Europe is good news for UK exports as increasing growth in UK export markets more than offsets the negative impact on exports from the stronger GBP against the EUR.

The GBP depreciated against both the EUR and USD following the release. The weak figures support our view that the GBP will weaken against the USD ahead of the election on 7 May.

See the following page for illustrative charts.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.