Our call for geophysical events unfortunately manifested in Japan and some other countries experiencing earthquakes greater than 6 (Vanuata, Burma, Afganistan, Guatemala).

We are still in the time window (all next week) where we could experience more quakes or the other events noted on the April 9th blog post and subscriber letter. Other events noted were war-like activity or terrorist event and potential violent weather.

SP500

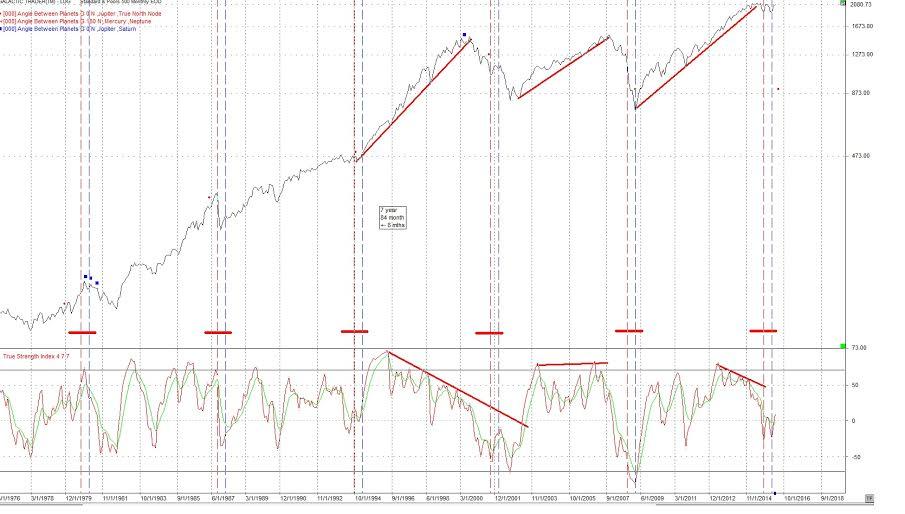

For the SP500, cycle-wise Feb 11 was the Primary cycle trough. 1 that started on Aug 24th. Feb 11th was a slightly lower low than Jan 20th low. Jan 20th was the low for a number of other indices. Feb 11th starts a new nominal 18 week cycle in the SP500 and we are entering the 10th week. We most often see a nominal 6 week cycle to start a new nominal 18 week cycle and this time was no exception. The crest is MT and the trough is MB on the following daily chart. The nominal 6 week cycles has a range of 5 to 7.

Another point from last weeks blog:

"We may see a rise in the indices during this week, or the early part of the week, before a more major move down."

So we had the move up now I'm looking for a move down.

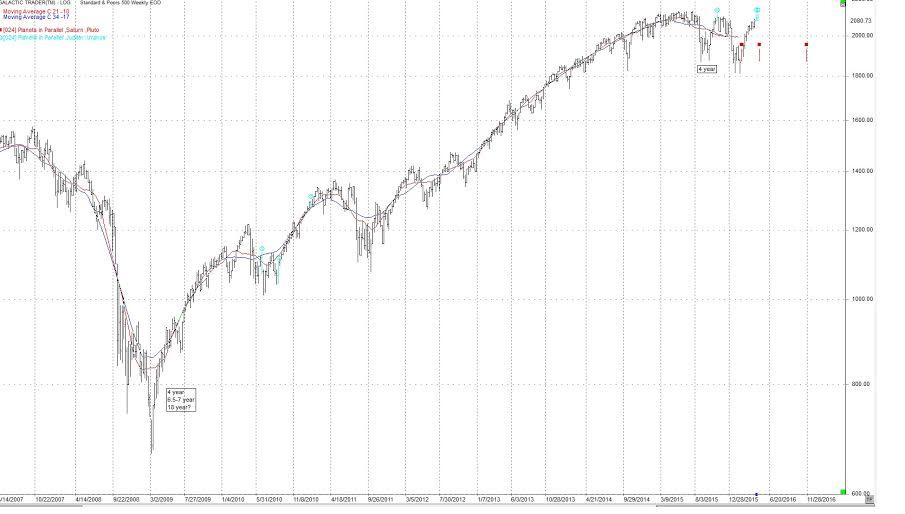

Declination is the measurement of planets north or south of the celestial equator which is the Earth's equator extended out into space. Look at declinations as a vertical measurement. It is the angle a planets make to the celestial equator. Look at the normal aspects in longitude as a horizontal measurement.

When 2 planets are at the same declination point they are said to be in parallel. If the two planets are at the same declination point but one is North and one is South of the celestial equator, they are said to be contra parallel.

The new nominal 18 week cycle which started on Feb 11 is therefore forecast to end as a trough approx. 18 weeks hence. That puts us in the week of June 13 with a range from May 30 to July 4th. If you look at that week we have the Saturn/Neptune square exact that week with Neptune turning retrograde on June 13th. These are the two main reasons why I'm looking at mid to late June as a significant low. There are other reasons which will be included in the subscribers report.

It could also be a time that epidemics break out or lingering disease around that time. This could also involve water.

Three weeks ago we had the Jupiter square to Saturn on March 23 which is 2 days before Saturn turns retrograde and we got the turn down in many markets we were expecting.

There was also a Saturn parallel Pluto aspect on Feb 9, 2 days away from the important Feb 11 date. Watch the days around April 28 for a possible low or start of a move down when Saturn is parallel Pluto once again.

Mars leaves Scorpio, where it has given Gold a huge thrust up and entered Sagittarius on March 5. This results in both Mars and Saturn in Sagittarius , a signature for a religious conflict or the amplification of one.

I'll be watching the U.S.A financial system/currency in follow up to the video from the February 29 post. This should be a long process. Note in the video the last similar occurrence took almost one year to see an effect.

With the longer term market cycles we use the Astrological aspects and Astrological events to determine a more exact time. Note: I have taken off the brief description of the Uranus / Pluto waning square. Longer term geocentric Astrological cycles that are coming up include:

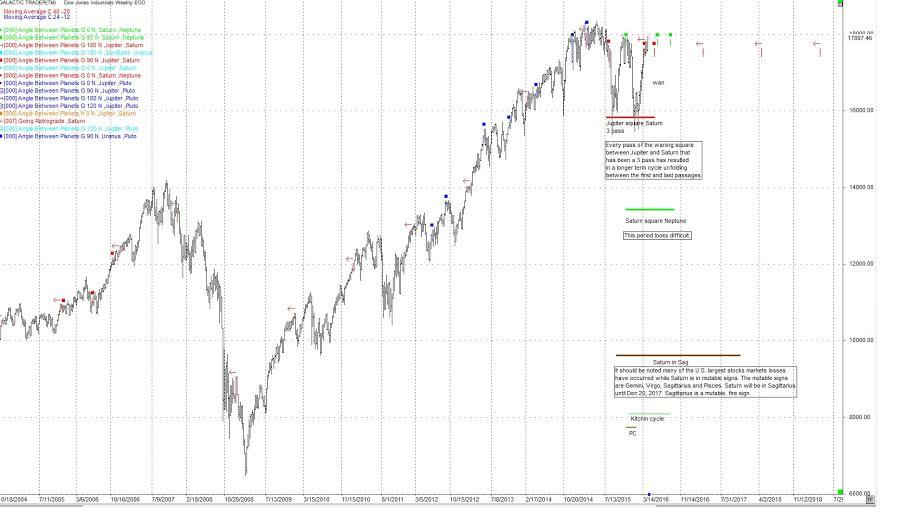

On the following weekly chart of the DJIA, the red squares are Jupiter square Saturn and the green squares are Saturn square Neptune.

Jupiter waning square Saturn

- in the middle of a 3 pass, 2 exact hits to come this year

"The business cycle and direct effect on European history. Major changes will be occurring in Europe as result of the refuge migration. There is a major sign change coming up when Jupiter and Saturn are conjunct in 2020. More on this 240 year conjunction in a future post."

Saturn square Neptune

- in the middle of a 3 pass, 2 exact hits to come this year

Saturn is about social order, structure and regulations. Neptune can be politically unrealistic and a desire to avoid confrontation. It can be devious, underhanded and use subversive tactics.

"This aspect is often present near times when there is a change in trend for interest rates or inflation. It can also be a period of epidemics, pandemics suffering, depression and money valuation problems. This could be a change in the world's reserve currency or issues around it. A large increase in precious metals is also possible as it is a money valuation issue. This 36 year aspect has been associated with political changes, reforms and development of socialism. One wonders in regards to epidemics and sickness, would "This aspect is often present near times when there is a change in trend for interest rates or inflation. It can also be a period of epidemics, pandemics suffering, depression and money valuation problems. This could be a change in the world's reserve currency or issues around it. A large increase in precious metals is also possible as it is a money valuation issue. This 36 year aspect has been associated with political changes, reforms and development of socialism. One wonders in regards to epidemics and sickness, would this be natural illnesses or man-made." If you feel depressed or not at ease this aspect may be the cause. One of these planets may be hitting a planet in your horoscope.

For 2016 we have Jupiter, Saturn, Neptune and the North Node in mutable signs. In addition both eclipses are in mutable signs. Mutable signs are about flexibility and the ability or need to change. They are also about things that are not in control and extremes. We are in for a wild ride for the next couple of months in the markets and other areas of life.

With all these planets in mutable signs one might expect a fast changing, exciting, fun environment. Let's not forget that Saturn is the focal point of a T-Square, with a square to Neptune. Amongst other things Saturn is fear. This could be pointing to life threatening epidemics and with Neptune this could mean water borne diseases. Natural or man-made?

For April, Mars and Pluto will be turning retrograde within a day of each other. This will probably be the most important Astrological event for the month. This time frame is also tied to the Jan 11, 2011 Solar Eclipse. That's right 2011. In my opinion this eclipse kicked off the "Arab Spring". From that eclipse date Uranus has moved to now square Mars position in the Jan 11, 2011 eclipse.

Following is a link to a post and picture of that eclipse. If there is going to be a major world event in the mid-April time frame (April 15-20) it will probably be within the area covered by this eclipse. Note it's coverage, the Mid East and Europe.

The next 2 charts are daily charts of the SP500, and the Russell 2000. The horizontal blue lines are the average longitude of the planets Jupiter, Saturn, Uranus, Neptune and Pluto on all 3 charts This average is converted to price and displayed on the charts. Notice how well they have acted as support and resistance. The SP500 is sitting on one of the Fib retracements at 88.6% .

The red vertical lines on the chart are the 45 cd cycle. This cycle has been accurate since May 20, 2015, the all time high. It appears to have run it's course as there was little movement around the date of the 45 cd. I'll look for it the next time it hits.

The second chart is the Russell 2000. This index is subject to far less manipulation than the SP500. Notice how well it respects the Astrological average price lines. It's too bad we have to bring up manipulation but the reality is, it happens.

Other longer term cycles that may be close to seeing their lows in the next couple of months are the 6.5 - 7 year cycle. I'm looking at the period from now through the spring of 2016 as a potential time period for these cycles. They are long term cycles and need a broad orb. Assuming the 2009 low was an 18 year cycle low, we may be looking at a 9 year cycle low late 2017 - 2018.

I was asked for my long term view and here it is. I'm looking for the world wide economy to be basically down until 2020. This coincides with a long term Astrological phenomenon known as Tigonalis which involves the Jupiter/Saturn conjunctions. Every 240 years the conjunction of these planets changes elements. In 2020 the Jupiter/Saturn conjunction will occur in Aquarius, a fixed, air sign. I expect dramatic technological developments leading into this time which should be, like the internet, life-changing developments.

To summarize the next couple of weeks.

A note. Early in the week I'll be playing this as a move down in the SP500. If the markets are continuing up then I'll revert to playing it as a continuing up move.

I mentioned Venus transits in the last video. Venus is in transit to both Saturn and Pluto on April 18 and 19th. One of the parallels mentioned above is the Saturn / Pluto Parallel. on April 28th. The aspects to these planets from Venus could highlight the energies of both Saturn and Pluto. Energy that could represent loss, fear and change that won't be undone.

We may in for an exciting couple of weeks. The Jupiter / Neptune opposition can indicate deceit, illusion and with both squaring Saturn, the planet of fear we could see some dramatic moves. The FED appears to be organizing something behind the scenes.

"Everybody knows that the dice are loaded

Everybody rolls with their fingers crossed

Everybody knows that the war is over

Everybody knows the good guys lost

Everybody knows the fight was fixed

The poor stay poor, the rich get rich

That's how it goes Everybody knows

Everybody knows that the boat is leaking

Everybody knows that the captain lied

Everybody got this broken feeling

Like their father or their dog just died"

-- Leonard Cohen

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.