Gold

Mars transit through Scorpio has ended and I'm expecting a nominal 18 week cycle low. We are in the 18th week. This cycle has a range of 15 to 21 weeks.

Gold could turn down at any point here, probably this coming week, but the time period around the Mars retrograde of April 17th +- a few td's, would be the best timing for a deeper low.

I'm ignoring shorter term cycles until this nominal 18 week cycle low is in. After Mars turns retrograde it will move back into Scorpio on May 27th. This should be an important period for Gold and precious metals. One exception is heliocentric Mercury in Gemini. There are often important turns during heliocentric Mercury transit through Gemini. This is from April 2 through April 6th.

March 11 looks like it was the peak of the cycle. I'm now looking for Gold to trend down into the nominal 18 week cycle trough which should be in the first half of April and as just pointed out near the Mars retrograde date of April 17th.April.

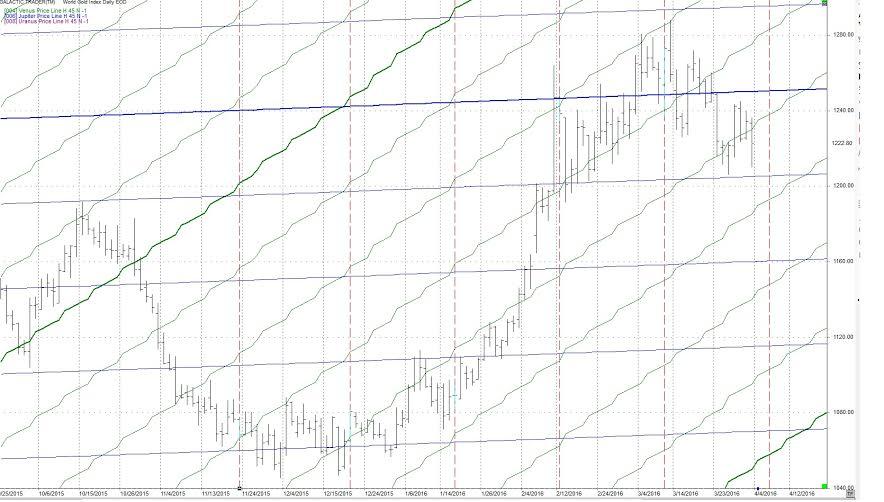

Watch the fib retracements on the following chart for both support and resistance areas. Markets will often go down and be between the 50% and 38.2% Fibonacci retracements. In this case that would be a low between 1165-1194.

Notice Gold price is lower than the 15 day sma which is pointed down and getting close to the 45 day sma. Price moving below the averages are typical for a market entering the 18 week cycle low.

The 15 day sma is the 1/2 cycle to the 6 week cycle and the 45 day sma is the 1/2 cycle to the 90 day or 18 week cycle. All days being td's (trading days).

I'm also expecting Gold to rise again in the spring time frame. I should have forecast dates for the next report. May 27 would be a good start.

On the following daily Gold chart notice Gold started to follow the heliocentric Venus (green) price line up, went down on the 27 cd cycle and now seems to be falling. I'm expecting Gold will move down. The 27 cd cycle hit March 9, 2016, close to the Solar Eclipse and Sun opposing Jupiter. This was 2 days off the Gold high on March 11. The next 27 cd cycle is April 6th.

As with other price lines the values are based on the heliocentric longitude of the planet in question and the longitudinal value is converted to price. The 27 day cycle is the Moon cycle. That is it takes 27 days for the Moon to orbit the Earth. It then takes 2+ days to catch up because the earth has moved during the Moon's rotation. 27 days is also the number of Earth days for the Sun to make one rotation at it's equator.

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.