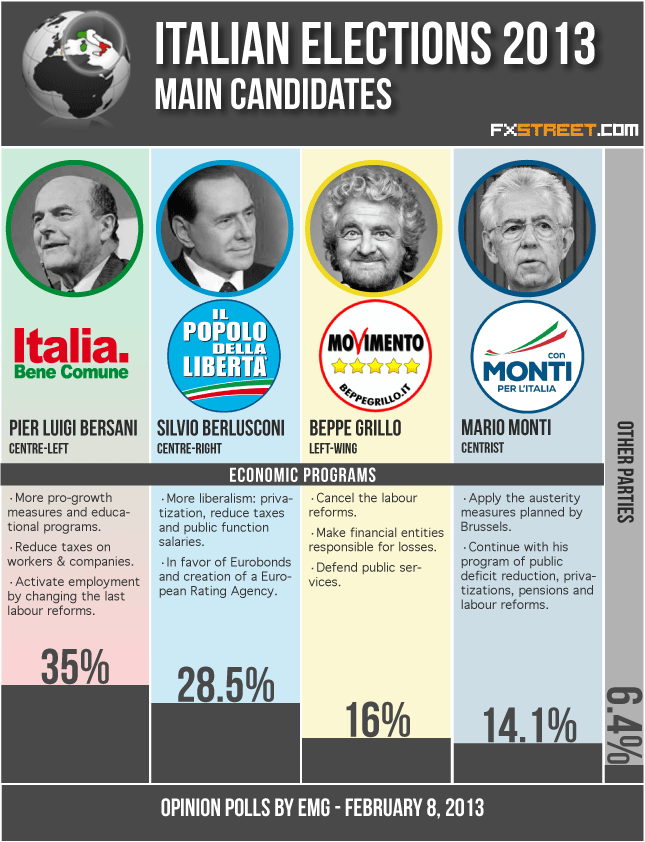

The frontrunners in the election are the head of the center-left Democratic Party (PD) Pier Luigi Bersani and center-right People of Freedom (PDL) party's leader Silvio Berlusconi. Third in the opinion polls comes the comedian turned populist politician Beppe Grillo an his 5-Star movement (5SM). The current Italian Prime Minister Mario Monti leading the Civic Choice coalition party also takes part in the elections, but is not expected to claim victory, but rather be a “kingmaker”.

The outcome of the election is crucial as the new government will have to make head against the fiscal crisis consuming the country and implement reforms in order to prop up the ailing economy. A failure to do so would have dire implications for Italy and consequently the entire Eurozone as providing a bailout for such a large economy might prove to be impossible. As chief economist at Maverick Intelligence Megan Green suggests in an article for Bloomberg: “The next government in Rome may be stable or reformist by Italian standards, but it will not be both.”

In her opinion the worst choice for the Italian people would be Berlusconi, whose victory would most probably be greeted by financial markets with distrust and would lead to dumping Italian bonds. “A victory for Bersani’s coalition in both chambers could make the process of making and implementing government decisions faster and easier,” Megan Green believes, but she nevertheless doubts its efficacy in implementing all the necessary reforms on time.

Marc Chandler, Global Head of Currency Strategy at BBH suggests that the best solution would be an alliance of Bersani's PDL with Mario Monti's centrist coalition which would ensure both a strong government and a consistency in pursuing the reform plan.

But the analyst sees some obstacles in this case as well: “This scenario crucially depends on how well Monti's centrists do. In such a coalition it is also not clear the position Monti can hold. The PD leader Bersani is unlikely to move aside to allow Monti to be premier and finance minister would be a step down for Monti. Some kind of super-minister, or minister without a portfolio might not give him the power base needed to secure his agenda.”

Despite the uncertainty as to whether any of the front running candidates will be able to effectively fight off the crisis in Italy once they come to power, the possibility of an inconclusive outcome in this weekend's election would be a real blow, causing a drastic sell-off in the markets.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.