View the Live chart of the EUR/USD

Finally out, the April US Nonfarm Payroll showed that the economy created less jobs than expected, and that salaries barely advanced. Overall, the report was mixed, yet the greenback continued gaining, particularly against its European rivals. Why? because the weak side of the report was not enough to deny the possibility of a rate hike in June.

Despite growth stalled in the US mid 2015 and slowed by the end of the year, situation that extended into the first quarter, there's an unexplainable sentiment that the FED will rose rates anyway at least two time this year, the first one in June and the second one in December, with September elections preventing the FED from acting that month.

The US Central Bank has largely repeated that rate hikes are data dependent, and if we rely on the latest macroeconomic indicators, the FED should remain on hold for longer. But market's hopes are strong, and investors are not willing to push the greenback so much lower.

The upcoming week will be fulfilled with macroeconomic data, and probably Chinese one will be the most relevant, as it will give some clues about worldwide health. If China picks up, the rest of the world will likely follow, and therefore the pressure over US economy will become to ease.

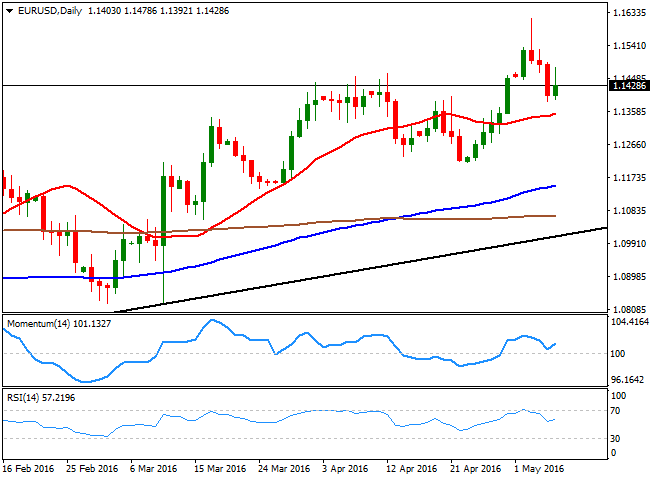

Anyway, The EUR/USD pair is not yet ready to give up, according to technical readings, as in the daily chart, the technical indicators have bounced from their mid-lines after correcting overbought readings, while the price remains well above its moving averages, with the 20 SMA around 1.1350 an 100 SMA 200 pips lower. In the weekly chart, the pair tested the 100 SMA before retreating, whilst the technical indicators have lost upward potential but remain well into positive territory, all of which maintains the risk towards the upside.

To confirm further advances, however, the price needs to settle above 1.1460 and then run through 1.1530 to be able to retest the highs above 1.1600 and extend up to 1.1713, August 2015 daily high. A decline through 1.1350 can see the pair sliding towards 1.1280, while further decline below this last can see the pair ending the week in the 1.1160/1.1200 region.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.