The EUR/USD pair trades mute above the 1.1300 figure this Tuesday, having advanced up to 1.1344 so far today. Data coming from Europe resulted mixed, as the ZEW survey showed that assessment of the current situation decreased in April, but he economic sentiment improved for Germany and the EU, as latest positive data coming from China, eased concerns over a global economic slowdown.

View the Live chart of the EUR/USD

Also, and in February, the current account of the euro area recorded a surplus of €19 billion, while January readings were revised to €27.5B. Finally, Construction output in the region fell by 1.1% in the same month, well below the previous 3.6%.

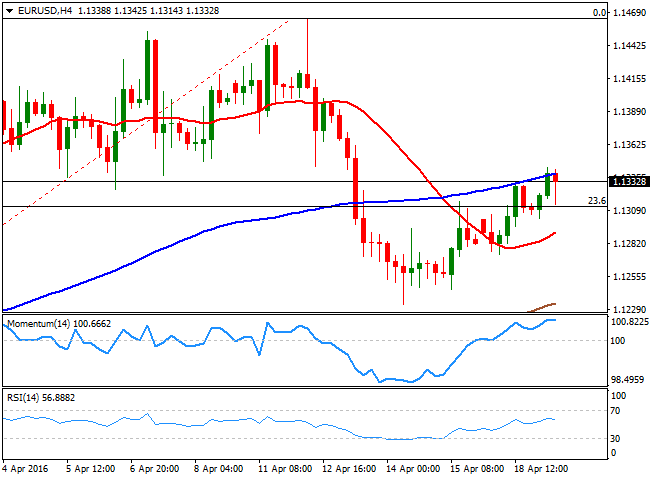

The common currency, however, failed to react to the data, and trades near its daily high, still unable to clearly overcome the 1.1330 region, which has been a strong support in the past two weeks.

The pair presents a limited bullish potential, as in the 4 hours chart, the technical indicators have turned lower after a period of consolidation within bullish territory, whilst the price continues being trapped between its moving averages, with the 20 SMA heading slightly higher below the current price and the 100 SMA converging with the current price.

The EUR/USD pair lacks directional strength at the time being, although the downside seems well limited, given market's positive mood. Some follow through beyond the daily high should see a quick extension towards the 1.1390/1.1420 region, whilst above this last, the pair can retest the 1.4060 price zone.

The key support comes at 1.1270, as only below this last the pair will turn short term bearish, towards the 1.1220 level, the 38.2% retracement of the latest daily bullish run.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.