The American dollar managed to recover some ground this week, except against commodity-related currencies, which advanced on the back of strong comeback in worldwide stocks. In fact, it was the same reason which supported the greenback, as quite constructive Chinese data spooked fears of a global slowdown, at least temporarily. Nevertheless, dollar's gains are far from suggesting that its bearish trend is over. In fact, the negative tone of the greenback will likely persists until the upcoming FED's meeting, next April 26-27.

View the Live chart of the EUR/USD

On Friday, however, dollar's rally was interrupted, as stocks were unable to extend their rallies, and oil prices turned south, as speculators rushed to take out profits, ahead of the Doha, Qatar meeting this weekend. Oil producers from all around the world will meet this Sunday to discuss the possibility of an output freeze. Hopes of an agreement are limited, as Iran is clearly refusing to join and other countries won't reduce production if Iran doesn’t.

Also, weighing on the greenback were poor macroeconomic readings as Industrial Production fell by 0.6% in March, following a 0.5% decline in February, whilst the University of Michigan’s preliminary consumer sentiment index fell to 89.7 in March the lowest since September 2015.

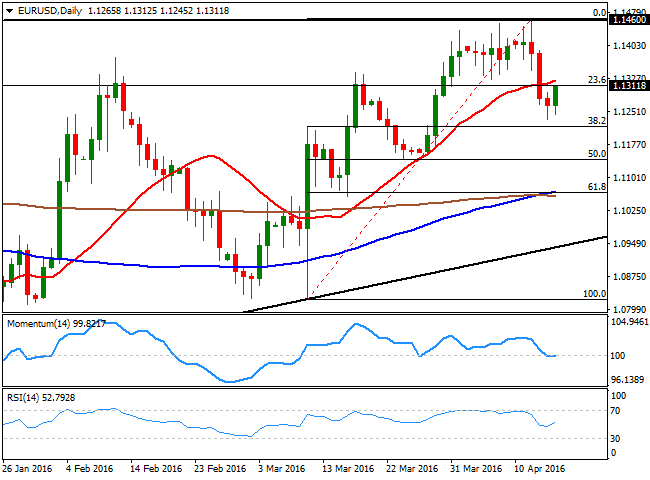

From a technical point of view, the pair topped out at a major static resistance level this week, the 1.1460 mark, before shedding over 200 pips. In the weekly chart, is clear that the level is a major long term resistance, as the pair has been unable to settle above it since January 2015. In the same chart, the weekly slide has forced technical indicators towards the downside, although they remain above mid-lines, whilst the 20 SMA maintains a strong upward slope around 1.1060, also the 61.8% retracement of the latest bullish run between 1.0821 and 1.1461.

Daily basis, the pair has managed to regain the 1.1300 level, but remains below 1.1330, the base of its latest range. The price is developing below a bullish 20 SMA, whilst the price halted its recovery around the 23.6% retracement of the mentioned rally. Also, and in this last time frame, the technical indicators have turned flat around their mid-lines, maintaining a neutral stance into the close.

Overall, and despite the weekly retracement, the upside remains favored as long as the price remains above 1.1220, the 38.2% retracement of the mentioned advance. Below this last, the decline can extend towards the 1.1120/60 region next week, whilst a break below it will favor a decline down to 1.1060, reverting then, the ongoing bullish trend.

An immediate resistance comes at 1.1330, but it would take a recovery above 1.1380 to see the pair rallying back towards the 1.1460 region. A break above this last, could see the pair up to 1.1713, August 2017 monthly high.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.