After a dull beginning of the week for the EUR/USD pair, it finally sky rocketed to its highest in almost a month, after the ECB pulled out a series of measures to boost inflation and growth. Investors were expecting a 10-15bp deposit rate cut, and maybe an extension of QE, but they were caught off guard when the main rate benchmark was cut to 0.00%, and four new TLTRO's were offered, alongside with QE being extended to €80bn a month starting next April and the deposit rate slashed to -0.4%.

The EUR/USD began to shed ground with the announcement, but all of a sudden advanced near 500 pips, on Draghi's wording about further rate cuts. The ECB's head showed that the Central Bank is concerned about cutting further, and therefore harming local banks, and said that the Government Council sees no need for further rate cuts.

But why the market reacted that way? well, mostly because it believes that Draghi has wasted all of its bullets, and that this measures have proved insufficient during the past two years, and therefore, will do little for the economic future of the EU. Nevertheless, market overreacted to the news.

View the Live chart of the EUR/USD

Now that the dust settled, and all eyes turns towards the US Federal Reserve meeting next Wednesday, market´s participants seem to have changed their minds and consider that ECB measures are not that bad after all. Also, the FED is expected to remain on-hold this year, which means that there's little interest of buying the greenback, and that the currency will remain subdue. Unless of course, the FED also pulls something out its sleeve, but who knows?

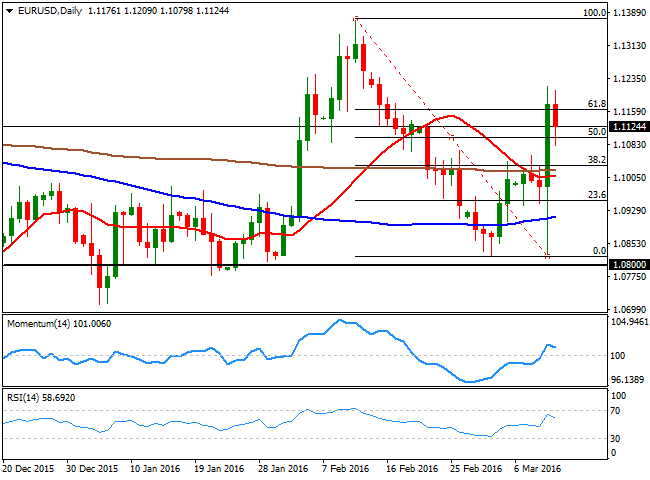

In the meantime, the pair seems poised to end the week above the 1.1100 figure, also the 50% retracement of its latest bearish move. The technical indicators have advanced beyond their mid-lines, but lost upward strength, indicating limited upward strength at the time being, but far from suggesting a downward move ahead. Additionally, the pair has managed to recover above its 200 DMA that has been capping the upside for most of the past two weeks. In the weekly chart, there's a general positive tone, with the price above its 20 SMA and the technical indicators within positive territory, but there's no clear upward momentum either.

The immediate resistance comes at 1.1240/60, a price zone in where the price has meet selling interest plenty of times during 2015. Should the price extend beyond it on a dovish FED, 1.1460 is the probable bullish target for the next week, the level that capped the upside for most of the past year. Below 1.1000 on the other hand, the risk turns towards the downside, with scope to test the 1.0800/40 region, a major static support level.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.