The EUR/USD pair extended its post-FED decline down to 1.0941, from where its currently recovering after the Eurozone Economic Sentiment Indicator rose to 104.0 in July, beating 103.3 consensus. Earlier in the day, news were less encouraging as German unemployment unexpectedly rose in July, posting its biggest increase since May last year. Unemployment rose by 9,000 against expectations of a 5,000 decline.

Later on in the day, the US will release its second quarter advanced GDP figures, the main event of the day. The US is expected to have grown 2.6% compared to the final reading of the Q1 of -0.2%. Expectations of accelerating growth are based on increased consumer spending, and the strong readings in the housing sector, as despite missing expectations lately, the figures remain near multi-years highs.

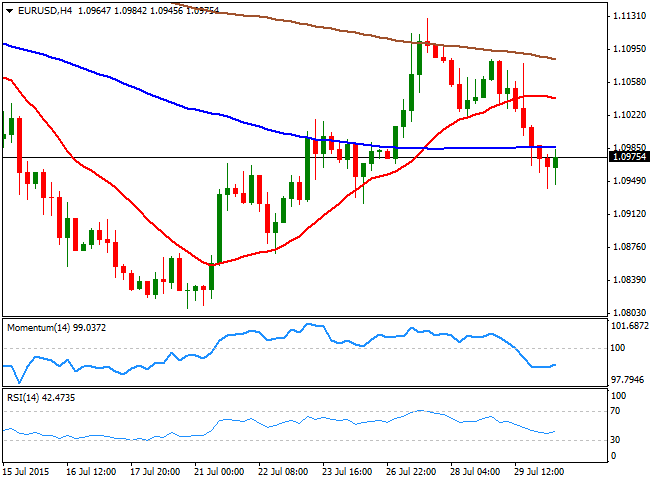

View live chart of the EUR/USD

Technically, the 4 hours chart for the EUR/USD pair shows that the price is well below its 20 SMA, although the technical indicators are aiming higher below their mid-lines, limiting at the moment, the chances of a new leg south. Nevertheless, as long as the price remains below 1.1000 the upside is well limited, with a break below the mentioned daily low exposing the pair to a steady decline towards the 1.0880 price zone, particularly if the US GDP results as strong as expected or better.

A recovery above 1.1000 on the other hand, should lead to an upward continuation towards the next intraday resistance, located around 1.1050.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.