The EUR/USD pair fell down to 1.1094 with the European opening, with the common currency weighed by Greece entering officially into default. Nevertheless, the latest letter from Athens making the rounds, shows that Tsipras is "prepared to accept this Staff Level Agreement subject to the following amendments, additions or clarifications." The pair bounced up to 1.1162 on the first sentence, but those "amendments, additions or clarifications" are yet to be seen.

Earlier in the day, European PMI's for June came out mixed, with German reading at 51.9 and the EU figure at 52.5, both matching market expectations. Italian and Spanish readings however, missed expectations. Later on in the day, the US will release its own manufacturing PMI along with the ADP survey ahead of tomorrow's Nonfarm Payroll report

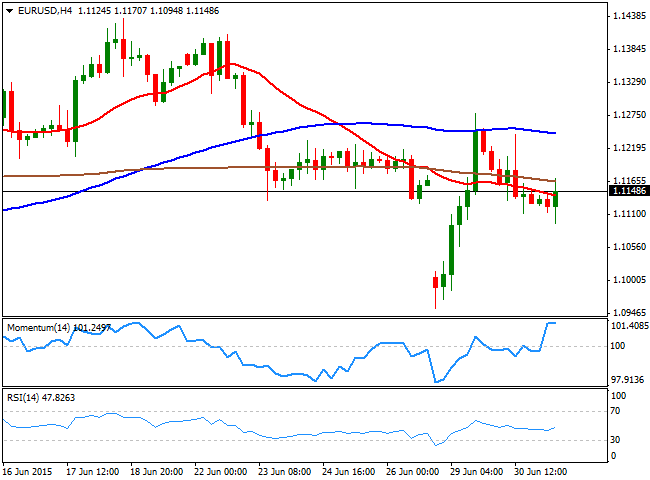

View live chart of the EUR/USD

Technically, the EUR/USD trades with a slightly positive tone, having erased all of its intraday losses. The 4 hours char shows that the price has advanced above its 20 SMA, whilst the technical indicators stand in positive territory, although with a limited upward strength. The key resistance stands at 1.1200 in the short term, with gains above it favoring advances towards 1.1245 and 1.1290 later, whilst renewed selling pressure below 1.1120 should see the pair down to 1.1080, in route to 1.1050.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.