Regarding Greece, negotiations are expected to continue over the weekend. The creditors have offered the country a 5-month extension to the current bailout plan, but the latest news suggest Tsipras wants a longer term deal, more in line with its anti-austerity policy. A deal must be reached before next Tuesday, June 30, or Greece will default on the €1.6B debt with the IMF. The implications have been largely discussed to exhaustion lately, with bank runs, and capital controls expected, alongside with the loss of the EU credibility. It's just a matter of who will give up first, Greece and face default, or Europe, and see how 15 years of work go down the toilet.

Given a holiday in the US on Friday, the country will release its monthly employment report on Thursday. Nonfarm payrolls tepid start of the year was reverted in May, as the economy managed to create 280,000 new jobs; the unemployment rate stood at 5.5% in the same month. With the Greece issue out of the picture, either for good or for bad, market's attention will likely return to the imbalance between Central Banks, and the FED's chances of rising rates. Should the report surge beyond May one and expectations, the dollar will likely close the week with strong gains against most of its rivals. A bad number on the other hand, may favor overall Pound, which is the one with more chances of advancing sharply on dollar weakness.

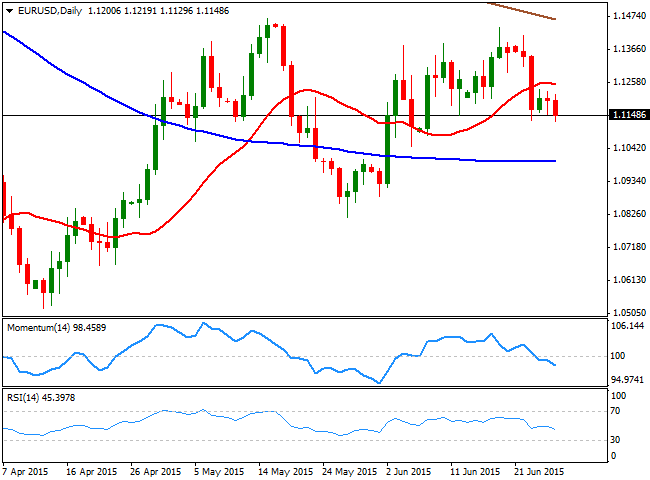

View live chart of the EUR/USD

EUR/USD Forecast: down to 1.1050 and beyond

As for the EUR/USD pair technical picture, it ended the week in the red, erasing half of the past three weeks advance. The weekly chart shows that the technical indicators have reversed sharply, with the Momentum heading lower but still above the 100 level, whilst the RSI has resumed its decline and heads south around 45. In the same chart, the 20 SMA stands flat around the critical 1.1000 figure.The daily chart shows a clearer bearish momentum, with the price having been capped by its 20 SMA for most of this past week, whilst the technical indicators head lower below their mid-lines. The pair has an immediate support around 1.1120, followed by 1.1050, both strong static support levels. Should this last give up, the pair will likely extend its decline down to the 1.0920/60 price zone.

The upside seems limited for the next week, with the immediate resistance around 1.1250. Above this level, the pair can extend up to 1.1400, albeit selling interest will likely prevent it from advancing further.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.