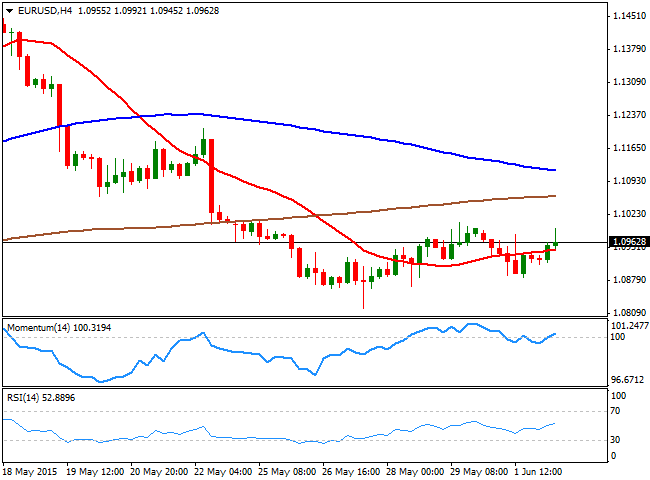

The EUR/USD pair spike up to a fresh daily high of 1.0994 following the release, but is now easing from the level, as strong selling interest remains aligned around the critical 1.1000 figure. Trapped in a 50 pips range, the 4 hours chart presents a mild positive tone, as the technical indicators hold above their mid-lines, albeit lacking upward strength, whilst the price develops above its 20 SMA. A clear break above the 1.1000 figure should lead to a spike towards the 1.1040/50 price zone, in route to 1.1120 a strong static resistance level.

A downward acceleration below 1.0950 on the other hand, should signal a downturn in the pair, eyeing a test of the 1.0890/1.0920 price zone, should the decline extend.

View live chart of the EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.