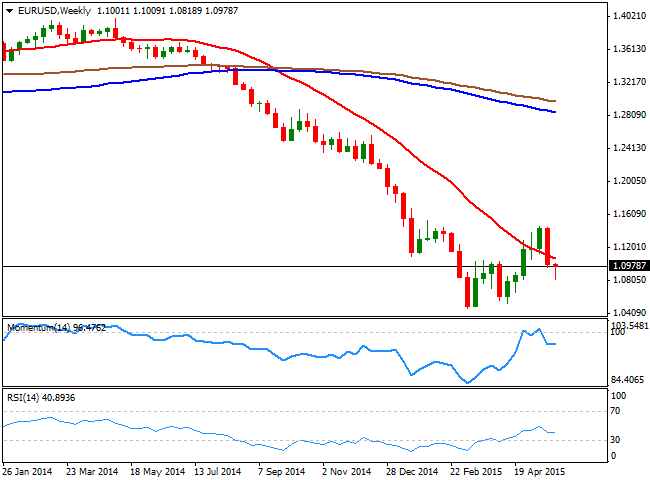

There will be several critical fundamental releases during the upcoming days, but the technical picture still favors the downside in the long run, as the weekly chart shows that the price is still below a strongly bearish 20 SMA around 1.1050, also a strong static resistance area, whilst the technical indicators maintain their bearish tone in negative territory. Daily basis, the pair trades below its 100 SMA, around 1.1030, and below the 20 SMA a 1.1150, whilst the Momentum indicator continues to head lower below 100 , whilst the RSI hovers around 44, all far from suggesting an upward reversal for the upcoming days.

For the upcoming days, 1.1050 is the key resistance level to follow, as a break above it exposes the pair to a quick run towards 1.1120, whilst above this last, bulls will likely take the pair closer to the 1.1300 region. To the downside, the main support now stands around 1.0860, with a break below it exposing the pair to a steadier decline towards the 1.0700 price zone by the ends of next week.

View live chart of the EUR/USD

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.