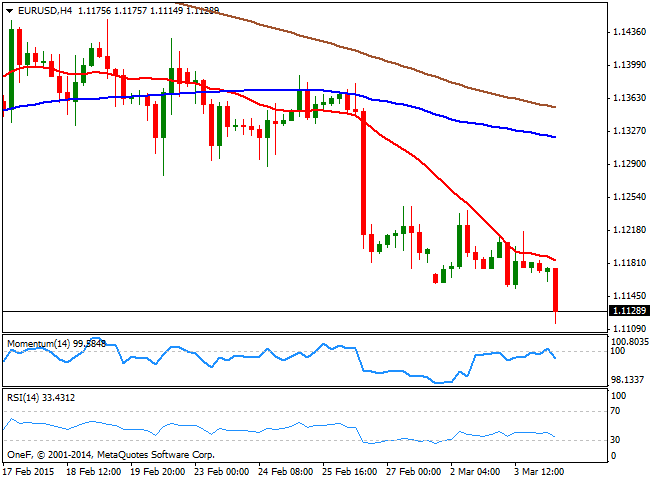

Nevertheless, the bearish tone accelerated with the pair poised to break below the 1.1100 figure. In the 4 hours chart, the price was unable to overcome a strongly bearish 20 SMA, currently around 1.1180, whilst the technical indicators turned lower, with Momentum retreating from its midline and the RSI indicator heading south around 33. Additional stops are likely standing below 1.1090, with a break below it fueling the slide down to 1.1050 in the short term, although further declines are unlikely ahead of ECB economic policy decision tomorrow. TO the upside, the mentioned 1.1150 level comes as the immediate resistance, followed by the 1.1180/1.1200 region.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.