EUR/USD is likely to have a week to remember. With volatility on the rise and many key events ahead, the market is about to start, what could be a historic December. After six months of closing between 1.09 and 1.12, the pair broke decisively to the downside and is about to post the lowest monthly close since 2002.

Currently, EUR/USD is moving with a clear bearish bias, in line with the dominant trend. Expectations of a rate hike in the US (the first since 2006) and more easing by the European Central Bank continue to be behind the decline and is likely to keep pressuring the pair. Next week will be very important for the euro and also the dollar.

The ECB will announce (or not) more easing measures and remove the uncertainty surrounding the meeting, giving support to the euro or opening the doors to more slides. In the US, the next Fed announcement will be December 16, but next week there will be two presentations of Janet Yellen and also the latest US employment report before the decision. A rate hike message from Yellen and a strong NFP report could increase even further expectations of a lift-off favoring the US dollar.

A combination of more easing by the ECB and a strong US jobs report could send EUR/USD below 2015 lows located at 1.0460 and would open the doors for a decline toward parity. The pressure on EUR/USD could continue until after the Fed’s decision when the pair could start to stabilize.

View the Live chart of the EUR/USD

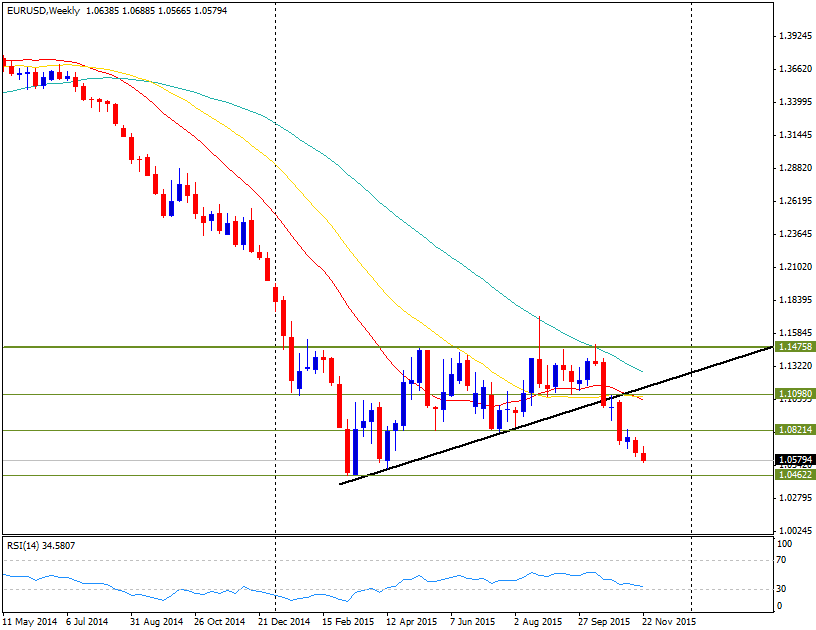

From a technical perspective, the pair is moving to the downside with indicators supporting the bias in every time frame. In the monthly chart, Momentum broke again below the 100 line, while in the weekly chart it appears to be targeting 2015 lows and RSI is moving south still above extreme levels. The price is well below key daily moving averages and since October 15 it has been falling constantly without important corrections. So far there are no signals of a corrective move; but if it happens it could be significant, not necessarily stable, amid profit taking and probable squeezes. The question is where or when could the correction start.

To the upside, if it rises and holds above 1.0650, it could remove some bearish pressure. On a wider perspective, as long as it remains below 1.0850, any rally should be considered corrective; only a consolidation above could suggest that a bottom has been reached. In the short-term, a close on Friday under 1.0600, would clear the way for a test of 1.0460; below here a potential target comes at 1.0250 and then 1.0000 would be exposed.

Over the next days, volatility could rise sharply with EUR/USD moving up and/or down, particularly during Thursday and Friday. Traders should take this into account in order to avoid undesired (excessive) losses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.