The week started in slow motion, with the EUR/USD pair confined to a 50 pips range, and having met selling interest on advances towards 1.1050. Chinese data failed to boost market sentiment, as the official manufacturing PMI remained below 50 in October, matching September reading of 49.8. The services sector grew less than previously, resulting at 53.1 against September figure of 53.4. The composite figure, which shows a snapshot of operating conditions in the manufacturing economy – posted 48.3 in October, up from 47.2 in September. Asian shares fell, and European ones are struggling around their opening levels.

German final manufacturing PMI resulted at 52.1, whilst the EU printed 52.3, both above expectations and previous. Except for France number, manufacturing seems to have started with a strong footing in the Q4. Later on today, the US will release its own PMI figures and some construction data, all of which may support some greenback rallies if the results beat expectations.

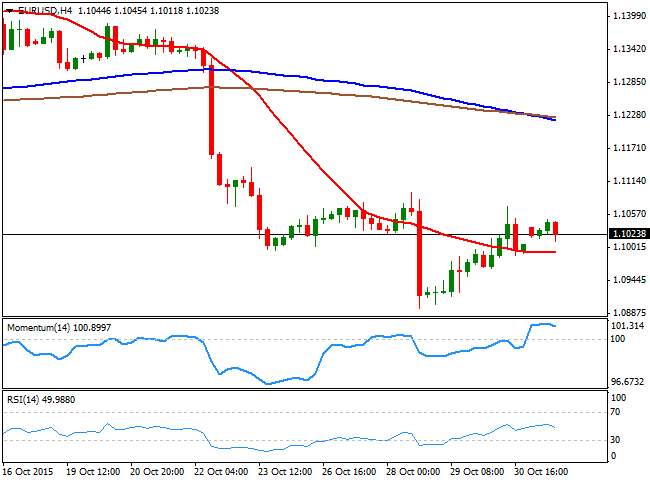

View the Live chart of the EUR/USD

The common currency remains subdued, unable to rally and with the EUR/USD pair trading above a flat 20 SMA, whilst the technical indicators continue retreating from overbought levels, limiting chances of a bullish run. A decline through the 1.1000 figure should see the pair accelerating its decline towards the 1.0950 region, with a break below it exposing last week lows at 1.0896. The pair has a strong resistance around 1.1080, and only a clear break above it can favor a rally up to the 1.1120/30 price zone.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.