The EUR/USD pair is pointing to close the week above the 1.1200 level for this first time in over a month, with the dollar hit by the latest FOMC Minutes, which erased the last hopes of a rate hike in the US for this 2015. And despite ECB Accounts of the latest meeting was also dovish, the European Central Bank maintained its status quo, confirming that they will maintain the ongoing QE until September 2016 or beyond, if required.

The global economic slowdown and the low inflation levels worldwide are the main concerns these days, and during the upcoming week, almost all the major economies will release their September inflation figures, poised to be the main market movers, and are generally expected to remain low. Even is the outcome results better-than-expected in one or some of them, it won't be enough to bring the due relief to investors.

View the Live chart of the EUR/USD

In the meantime, the EUR is surging alongside with stocks, which recovered strongly on the back of commodities rallying. The EUR/USD pair traded as high as 1.1378, and so far, is finding short term interest buying interest around 1.1335, a strong static support. The pair is also pointing to close the week above the post-NFP high, quite a significant bullish signal.

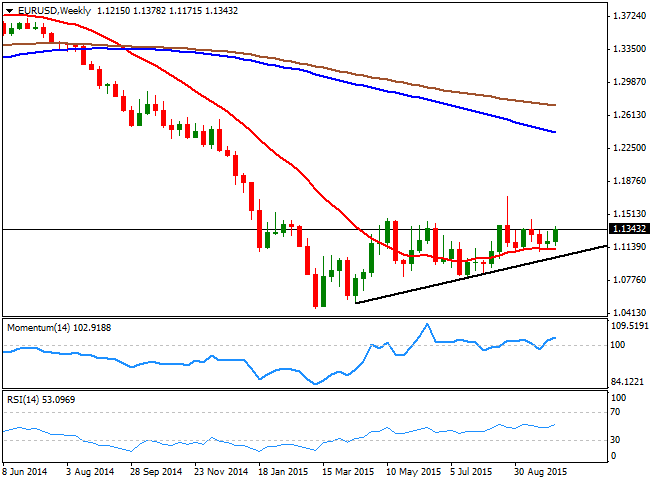

Daily basis, the pair is being led higher by a daily ascendant trend line coming from 1.1104, and the technical indicators suggest the rally may continue, as the RSI heads north around 59. The par is above its 20 SMA, but the daily moving averages remain horizontal, as a consequence of the limited monthly range since late July. In the weekly chart, the price has managed to held once again above its 20 SMA that also lacks directional strength, although the technical indicators head higher above their mid-lines, in line with some further advances.

The key level to watch now is 1.1460, as a break above is required to confirm additional gains, up to 1.1620 for the upcoming days. Above this last, 1.1713, the high posted last August, comes next. Below the mentioned 1.1335, the pair can go down to the 1.1240/60 region, where buying interest should appear to halt the decline and keep the upside favored. Below it however, the pair has scope to extend its decline down to the 1.1120/60 price zone.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.