The EUR/USD pair trades within a 40 pips range this Thursday, as investors are waiting for the first major event of the week: the ECB will have its economic policy meeting, including economic forecasts and a statement, in a couple of hours.

Additionally, Chinese markets have been closed due to a local holiday, and will remain closed until next week, which means the main risk factor that has been moving the markets these days is temporarily of. In Europe, stocks are strongly up supported by the latest manufacturing and services PMIs in the region that suggest the EU recovery is proceeding at pace. The EU Markit composite for August rose to 54.4 from previous 54.3, with only the French reading missing expectations.

Despite growth seems to be picking pace, the problem continues to be depressed inflation readings, which may force ECB's President, Mario Draghi a generally dovish stance, and remark that the Central Bank is willing to do whatever it takes to reach its 2.0% target.

View live chart of the EUR/USD

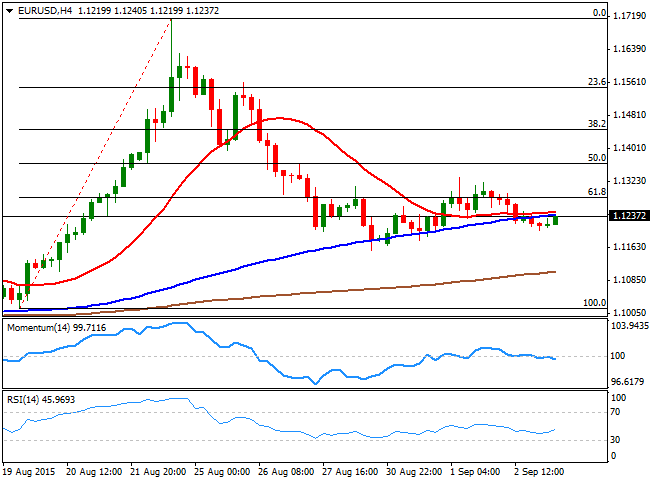

Technically, a slightly negative tone prevails, as the price is developing below its 20 SMA in the 4 hours chart, whilst the technical indicators present a neutral-to-bearish stance, standing slightly below their mid-lines. Nevertheless, upcoming movements will depend on how the market understands Draghi's words.

The main resistance level comes at 1.1280, 61.8% retracement of the past two weeks rally. An advance beyond the level should see the price spiking towards the weekly high around 1.1330, while beyond this last, the rally can extend up to 1.1360, 50% retracement of the same rally.

Below 1.1200 on the other hand, the risk turns towards the downside, with scope to test the 1.1160 region. A break below this last, exposes the pair to a decline down to 1.1120 a strong static support level.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.