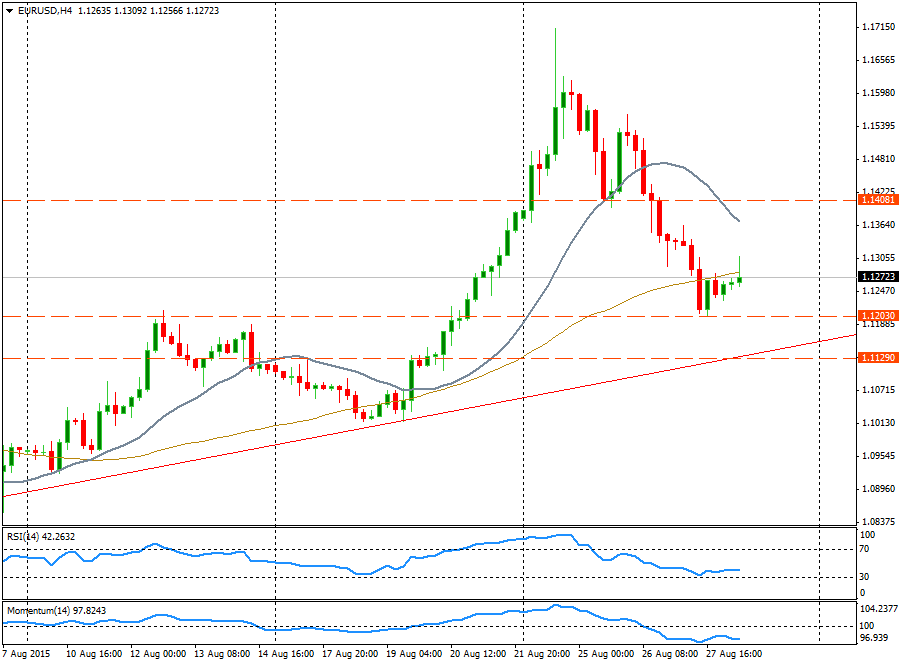

The EUR/USD pair is rising modestly on Friday, still headed toward a weekly loss, unthinkable on Monday when it was trading above 1.17000. It was a very volatile week for EUR/USD. After surging and then plummeting, it appears to be stabilizing.

Greenback lost strength after reaching 1.1200 during Thursday’s American session. Now the pair is holding a slightly bullish bias, with price above the hourly 20-SMA the stands around 1.1250/55; if it drops below, another test of 1.1200 seems likely.

The upside remains limited by 1.1300 today. If it breaks higher it could extend the rally to 1.1360/70. Around 1.1400/10 is where the key resistance is seen, likely to stop the upside on Friday; a consolidation on top would bring strength to the euro and support for further gains.

On a wider perspective, the decline from 1.1700 so far found support at 1.1200. The area located between 1.1150 and 1.1200 is an important and a strong zone. In the mentioned zone we could see an uptrend line and the daily 20-SMA. If the pair falls below and post an important close under, more slides are likely with a possible target around 1.1000.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.