The EUR corrected lower this Tuesday, down against the greenback to a daily low of 1.1051 from where the pair has posted a shallow bounce so far. There were no macro news in Europe but later on in the day, the US will release its PMIs and its Consumer Confidence index for July that could offer additional relief to the greenback. Nevertheless, the market is waiting for Wednesday's FED economic policy meeting that will hold the key for dollar's strength.

View live chart of the EUR/USD

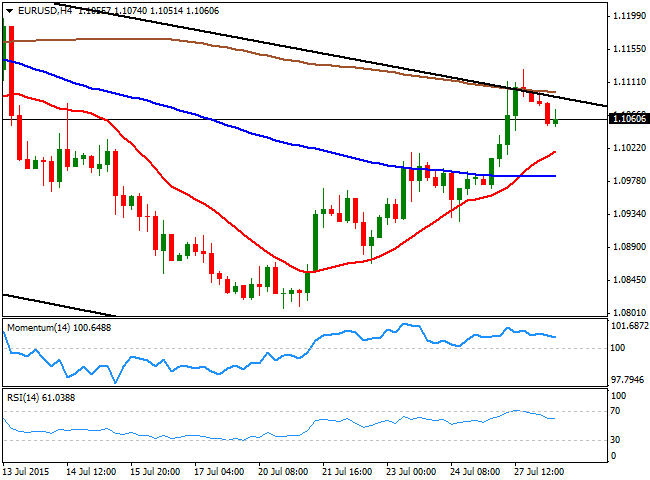

The pair remains within a daily descendant channel, but pressuring the top of it, and with the 4 hours chart showing that the price is well above a bullish 20 SMA, whilst the RSI indicator anticipates additional advances, regaining the upside around 61. The Momentum indicator in the mentioned chart, has lost its upward strength, but remains in positive territory. Nevertheless, as long as the price holds above 1.1050, the downside should remain limited, with gains beyond 1.1080 favoring a retest of Monday's high in the 1.1120 price zone. An upward acceleration above this last, should see the price extending up to 1.1160.

A bearish movement through 1.1050 on the other hand, should lead to further retracements towards the 1.1000 figure, where the pair will likely wait for the FOMC.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.