The EUR/USD pair has fell down to 1.1031 during the Asian session, as dollar buying has extended during the session. The pair however, recovered some ground in the European opening, trading a few pips above its daily opening. The Greek drama has seen no developments so far today, and moved to a second place, at least temporarily, as the US will release its Nonfarm Payroll monthly report.

Given the ongoing situation in Europe, there are little chances that the impact of the report will be something else than temporal, particularly against the common currency. Nevertheless, a strong reading, as anticipated yesterday by the ADP survey, should favor a strong intraday dollar rally. Expectations are of 232,000 new jobs added in June, and an unemployment rate of 5.4%.

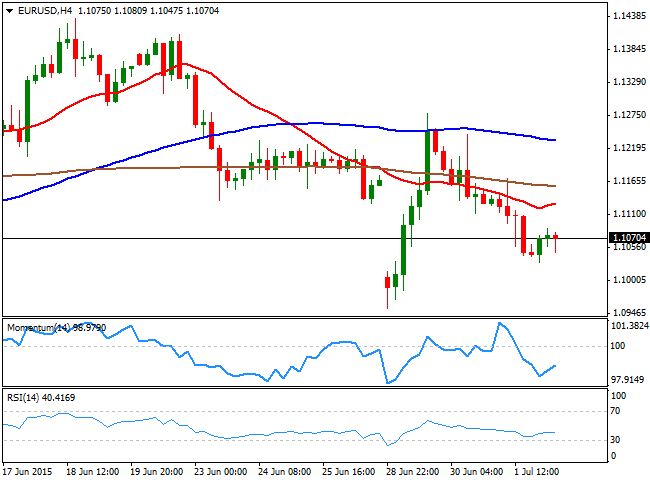

View live chart of the EUR/USD

The technical picture favors the downside, with the price developing below its moving averages and the technical indicators well below their mid-lines. However, upcoming market movements will depend on the report, and a break below 1.1050, should see the pair extending down to the 1.1000 figure, whilst a break below it should lead to a decline down to the 1.0950/60 region, this week low. A disappointing reading on the other hand, should push the pair beyond 1.1120, the immediate resistance, with the next resistances and probable bullish targets at 1.1160 and 1.1210.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.