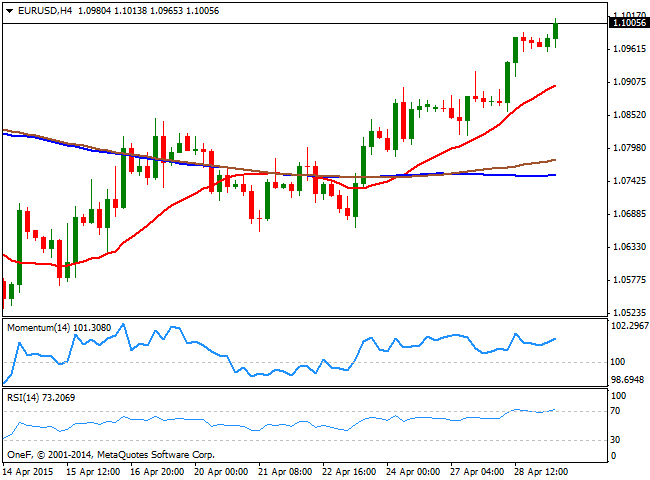

Technically, the pair maintains the bullish tone seen during the last sessions, as the 4 hours chart shows that the price extended further above a strongly bullish 20 SMA, currently around 1.0900, whilst the technical indicators are heading back higher after partially correcting overbought readings. The pair can advance up to 1.1050 now, but it's probable that investors will refrain from pushing it higher ahead of the news. Should the GDP readings disappoint, a break through 1.1050 should lead to an advance up to 1.1120, a key midterm resistance level. Further advances seem unlikely for today, yet if the level is taken, the 1.1150/60 area comes next.

To the downside, the immediate support comes at 1.0950 a strong static support, with a break below it exposing the 1.0900 figure.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.