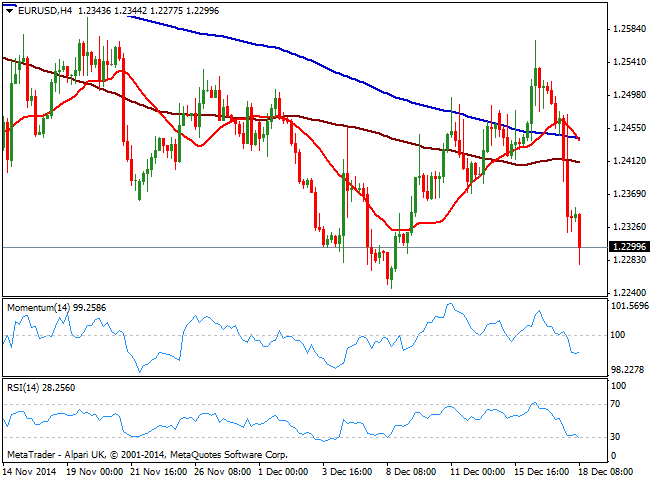

The strong slide triggered by the Federal Reserve’s latest decision has left 4 hours indicators in oversold territory, but there are no signs market will reverse course, as RSI continues to head south despite at 28. Market is more about sentiment than technical analysis today which means the risk remains to the downside, particularly if stocks maintain the positive tone. Immediate support stands at 1.2270 followed by the year low of 1.2240. If this last gives up, the 1.2200 figure comes next. To the upside, sellers will likely surge between 1.2330 and 1.2360, with a clear advance beyond this last to revert current bearish tone, at least in the short term.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.