Late Wednesday in Italy, he made a speech anticipating the may concern to discuss today is inflation. Among the remarks, he said that low rates are not enough to boost the economy, and that “fiscal and structural policies must also do their part.” And while market awaits him to launch more measures, there are big chances he decides to take a wait and see stance, having already repeated several times rates are at their lowest possible, after last meeting announcements.

In the meantime, stocks are in selloff mode, with US indexes at levels not seen since early August probably the main reason of recent short term dollar weakness. Japanese Nikkei lost in 2 days all of September gains, fueling yen gains.

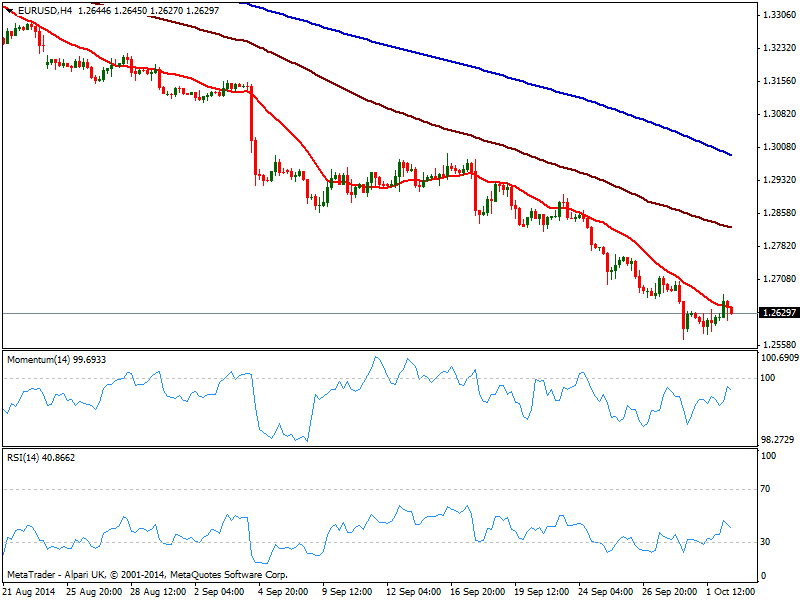

So what will the EUR/USD do? My take is that with no new measures, market may feel disappointed and resume the downside, with a break below recent low at 1.2570 pushing buyers out of the market and triggering stops: next downward target comes then at 1.2520/30 price zone. If on the other hand, the ECB head manages to favor its local currency, the recovery can extend up to 1.2740 price zone. Anyway, US employment figures early Friday will have the final word on whether the recovery can or not extend in time.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.