Selloff triggered stops in the EUR/USD, with market players now pricing in more action coming from the ECB on Thursday. But will this be enough to force Mario Draghi into full QE mode, or will the ECB head bring a wait and see stance? One way or the other, bears are in control, and despite the pair is due to an upward correction, there’s a long way up before a reversal can be called.

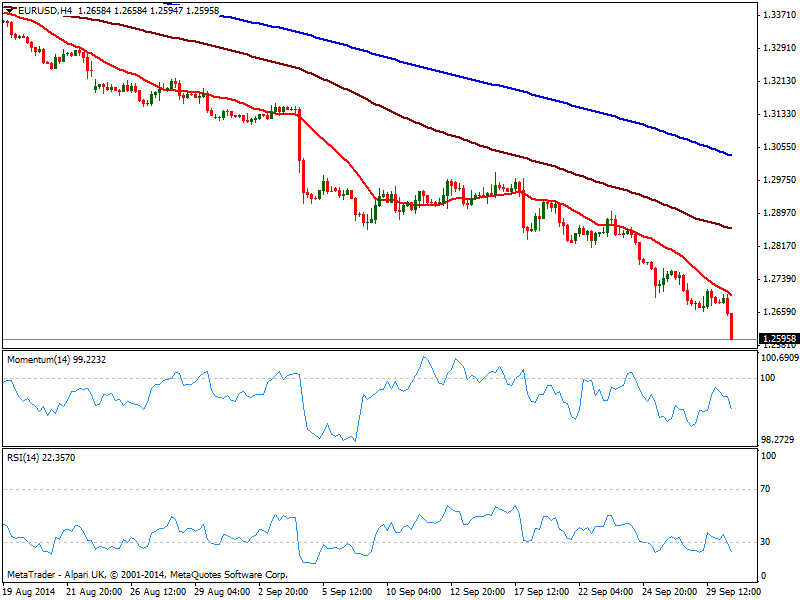

Technically, the 4 hours chart maintains the bearish tone, with price capped below a bearish 20 SMA now around 1.2680 daily high, with indicators heading strongly south in negative territory and RSI entering oversold territory. Some consolidation around current levels can be expected, before next move, with a downward acceleration through 1.2590 exposing the 1.2550 price zone in the short term. Immediate resistance stands at former lows around 1.2660, and pullbacks back to the level may be seen as selling opportunities; only above mentioned 1.2680 the bearish pressure may ease on the day, with a probable recovery then extending up to 1.2720/40 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.