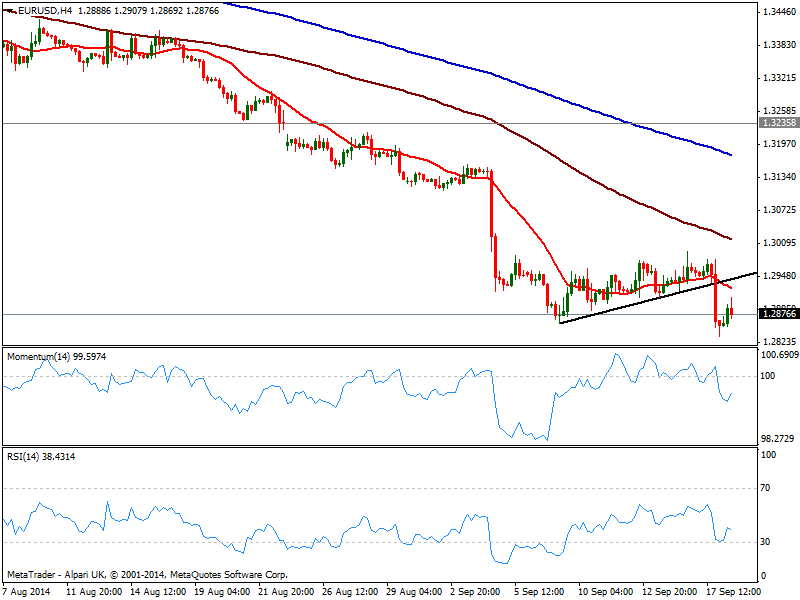

Having posted a fresh year low of 1.2834 post FED meeting, the pair maintains the overall bearish bias, with today’s recovery seen as corrective. The 4 hours chart shows price well below the daily ascendant trend line broken yesterday, with 20 SMA now offering dynamic resistance around 1.2920 and indicators steady in negative territory, with RSI turning lower after correcting oversold levels.

While the longer term has become clearer bearish, in the short term, as long as 1.2900/20 caps the upside, risk is towards a retest of mentioned low and lower, eyeing an approach to the 1.2800 figure. Once below this last, 1.2740 comes next. A recovery above 1.2920 on the other hand may see the pair correcting up to 1.2960 price zone, where it will complete a pullback to the broken trend line. Such recovery will hardly signal a bottom, but with put price back in its latest range and therefore diminish chances of a steady downward continuation.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.