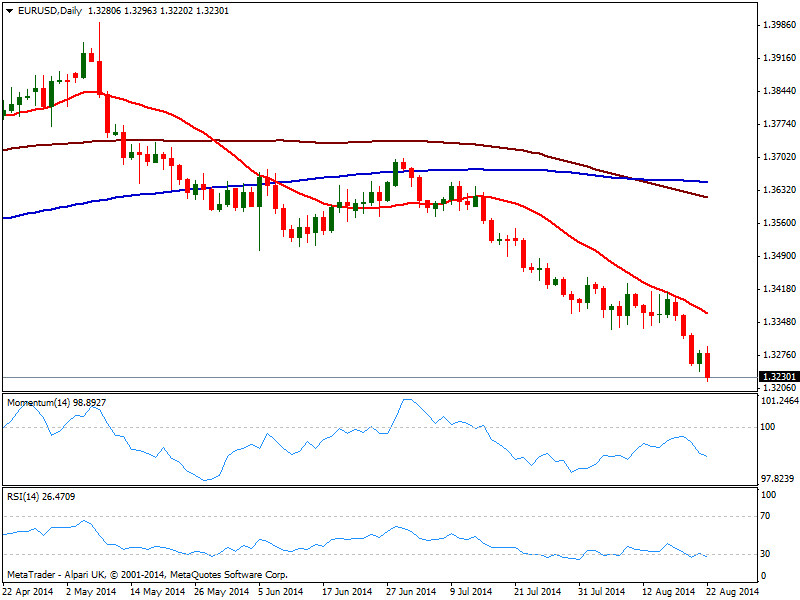

In Europe there were no major developments over the last few days, but there will heaps next week, including EZ inflation next Friday. Technically, the daily chart shows a quite clear bearish stance, with lower lows and lower highs daily basis, and indicators heading lower below their midlines. RSI has attempted to correct higher from oversold levels but turned south again, with price nearing the 1.3200 figure as the week comes to an end. Moving back to last year, the weekly chart shows several highs and lows in the 1.3160 area, turning it into a key support, as a break below the level exposes the 1.3000 psychological level.

Despite the distance, the resistance to watch over the next few days will be 1.3330 price zone, as it will be only above the level the bearish pressure will ease: movements up to the level should be understood as corrective and mere selling opportunities. If somehow the pair reverses and advances above this last, 1.3440 area is the possible bullish target then.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays near 1.2450 after UK employment data

GBP/USD gains traction and trades near 1.2450 after falling toward 1.2400 earlier in the day. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, limiting Pound Sterling's upside.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.